FTX: The Smartest Guys in the Room

Over a 5 day period ending on November 11th, FTX plunged from $32 billion market cap to bankruptcy. Seemingly overnight, one of the pillars of mainstream cryptocurrency adoption was evaporated. Billions in customer funds were stolen or missing, and the world is left picking up the pieces wondering what just happened.

Oddly enough, just days before the bank run which would bring down a crypto empire, I finished reading “The Smartest Guys In the Room: The Amazing Rise and Scandalous Fall of Enron.” The more I learned about the FTX collapse, the more similarities I saw with Enron. Regulatory manipulation, novel financial products, and a stunning collapse out of nowhere.

I try to keep it fun, but this is going to be a text heavy post. Both Enron and FTX are complex corporations and telling their stories, even the surface level, requires a lot of words. This post will tell the story of Enron, the story of FTX, then compare the two.

Friendly reminder that if you like the piece, you can subscribe for free by clicking below:

Away we go!

Enron:

Ask Why

In 2022, “Enron” is synonymous with corruption and manipulation, but it certainly didn’t start that way. The rise and sudden collapse of Enron has hundred-page books and multi-hour documentaries dedicated to covering the intricacies, something I wont be able to do here. I’ll go over the topline of Enron’s story, but to understand the vibe of what happened, the two-minute trailer for the 2007 documentary does a good job:

Founding and Near Miss

Founded in 1985, Enron was the product of a merger between two American natural gas companies. Following the merger, Ken Lay became the CEO of the new company. Lay, an economist, had worked in and out of the energy sector since 1965. During the late 60s and early 70s Lay served in a variety of energy-focused roles at the Federal Power Commission and Department of the Interior. Leaving DC in 1974, Lay returned to the energy sector to lead multiple transmission and pipeline companies, culminating in the previously mentioned 1985 merger to form Enron.

In the 1980s, the Federal Energy Regulatory Commission (FERC) issued several orders to introduce a market-pricing system for natural gas. These changes allowed for producers and purchasers to buy, sell, and move gas more easily. While many others missed it, Ken Lay, as a former policymaker and thought leader in the energy space, understood the massive opportunity FERC’s changes created. Ken Lay and Enron positioned themselves to capture the moment, creating a massive energy company in doing so.

While Enron was a success as a natural gas company, one way it maintained this success was through financialization and speculation. In a bid to raise its bond rating and status on Wall Street, Enron’s leadership took major strides to steadily increase profits each quarter. To maintain a meteoric rise, a subdivision called Enron Oil was responsible for using financial contracts to shift profits from quarter to quarter, hedge risk, and generally speculate on the price of oil. In 1987 Enron Oil’s speculators – in addition to stealing funds - went full tilt at the oil and gas poker table, racking up $1 billion in losses, enough to bankrupt the company.

While Enron was eventually able to bluff its way out of the crisis, it learned the wrong lesson. It wasn't that high-risk speculation and earnings manipulation was wrong, it was the lack of oversight and fraudulent traders. Instead of implementing adequate risk-mitigation strategies, Enron learned to double down and bluff your way out.

The Market Maker

In 1989, with its brush with bankruptcy far in the review mirror, Enron brought on Jeffrey Skilling to implement a revolutionary new business model: the gas bank. While Enron remained a large producer of oil and natural gas, it was slow and asset-heavy, requiring huge investments to generate new dollars. In contrast, Skilling devised an asset-light strategy in which Enron would serve as a natural gas market maker.

As a “gas bank” Enron would promise to deliver gas but would not necessarily produce it. For example, if Enron could sign a contract with a producer for less than the price it promised to deliver for, profiting the difference between the contracts. In this way, Enron’s trader would use their skills to purchase natural gas from producers and turn around and sell it to a purchaser at a higher price. While the model was simple the practice was anything but. Highly complex derivatives and other financial instruments were used to capture as much possible value between the two prices as possible. Some of the contracts Enron signed were 20 years long! This locked Enron's traders in to finding a cheaper supply for 20 years by hook or by crook.

Mark to Market Accounting

Enron famously used “mark to market” accounting beginning in 1991. While most businesses record income as cash comes in the door, mark to market allows the full lifetime value of a deal to be counted as income as soon as a deal is signed. For example, on a 20 year contract, Enron would record $200 million in income instead of $10 million each year for the next 20 years.

Mark to market accounting is critical for traders to account for the fair value of goods which can fluctuate over time. The price of oil today is different than the price tomorrow, so traders mark the deal according to its fluctuating value on the open market. Mark to market accounting thus introduces a lot of subjectivity into accounting practices. While this is fine for frequently trades derivative contracts on Wall Street, where a market price is readily available, it creates incredibly poor incentives for markets where little trading occurs. Thus, Enron had little to no incentives to revise their market marks when a project underperforms its revenue target by 50%.

Further, mark to market accounting enabled a deal-centric culture to emerge. Because “income” was tied to the price at the contract signing instead of the cash coming in the door, employees were incentivized to sign the largest deals possible as quick as possible. No one was responsible for ensuring cash actually came in the door.

Mark to market accounting, by allowing Enron to claim income for cash which may never come in the door, enabled Enron to cook its books, cover losses, and promote short-term thinking.

DC Focus

While many people – especially the documentary producers – will tell you that Enron was profitable because of misguided Republican deregulation, the opposite was true (1). Enron was successful because it helped create a complex regulatory structure in which it had an advantage. In a market which is somewhat regulated and somewhat deregulated, playing the refs is an easy way to gain an advantage.

Ken Lay was a major figure in DC, serving on the boards of multiple nonprofits and think tanks, as well as contributing over $100 million to candidates in 2000. While Enron was a major player in DC, it wasn’t successful in achieving most of its federal policy goals. For example, after the resignation of Rich Kinder, Jeff Skilling flew to DC to lobby Congress to fully repeal the Federal Power Act and allow organizations like Enron to operate the grid. When this received major pushback from then Energy Subcommittee Chairman Joe Barton, Skilling attempted to browbeat Barton into submission, dooming the play.

Enron spent millions on lobbyists and political donations, and while it was able to secure small victories, it never secured what it really wanted.

Structured Finance

While mark to market accounting sparked the fire, structured finance and securitization were gasoline leading to its rapid collapse.

Specifically, Enron:

- Manipulated Special Purpose Vehicles (SPEs) to hide debt off balance sheet

- Allowed its CFO to simultaneously serve as the Executive Director of these SPEs, enriching himself

- Posted its stock as collateral for the SPEs, meaning any significant decline in Enron’s stock would unravel the special vehicles and require immediate payment

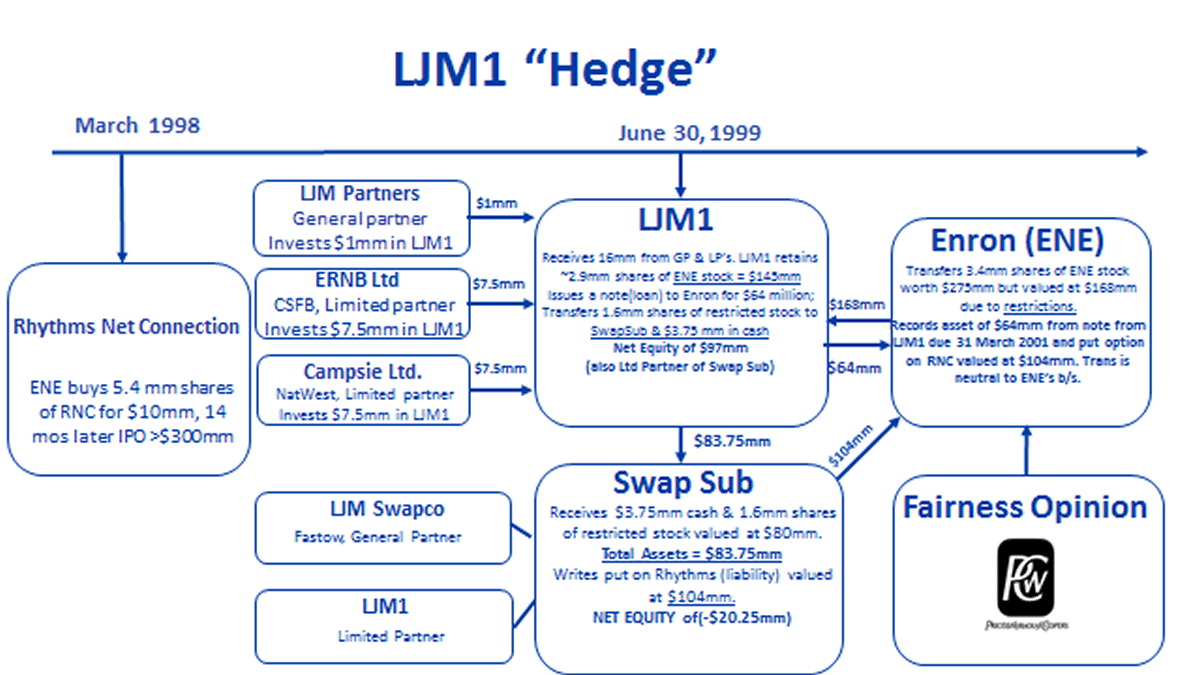

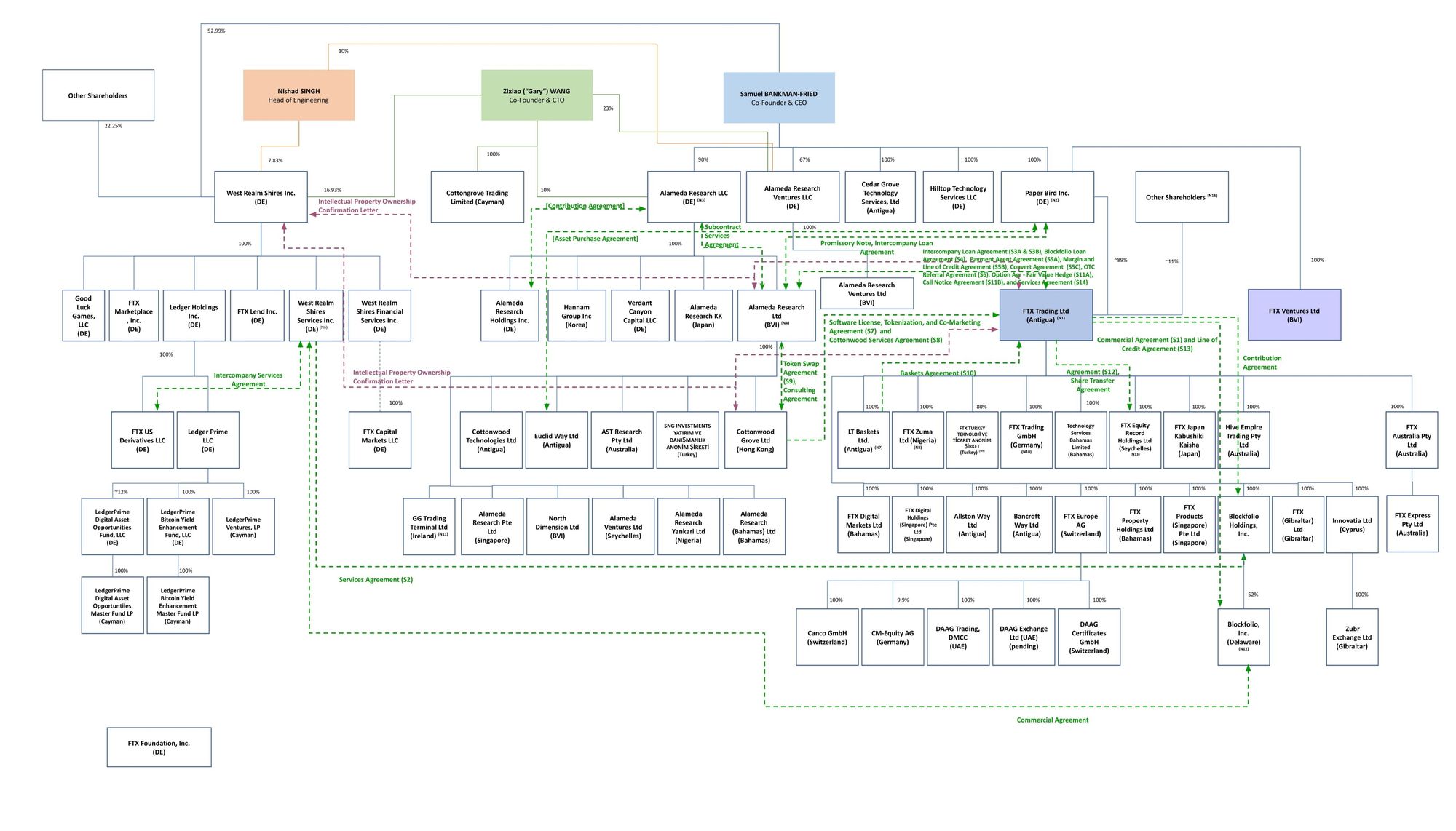

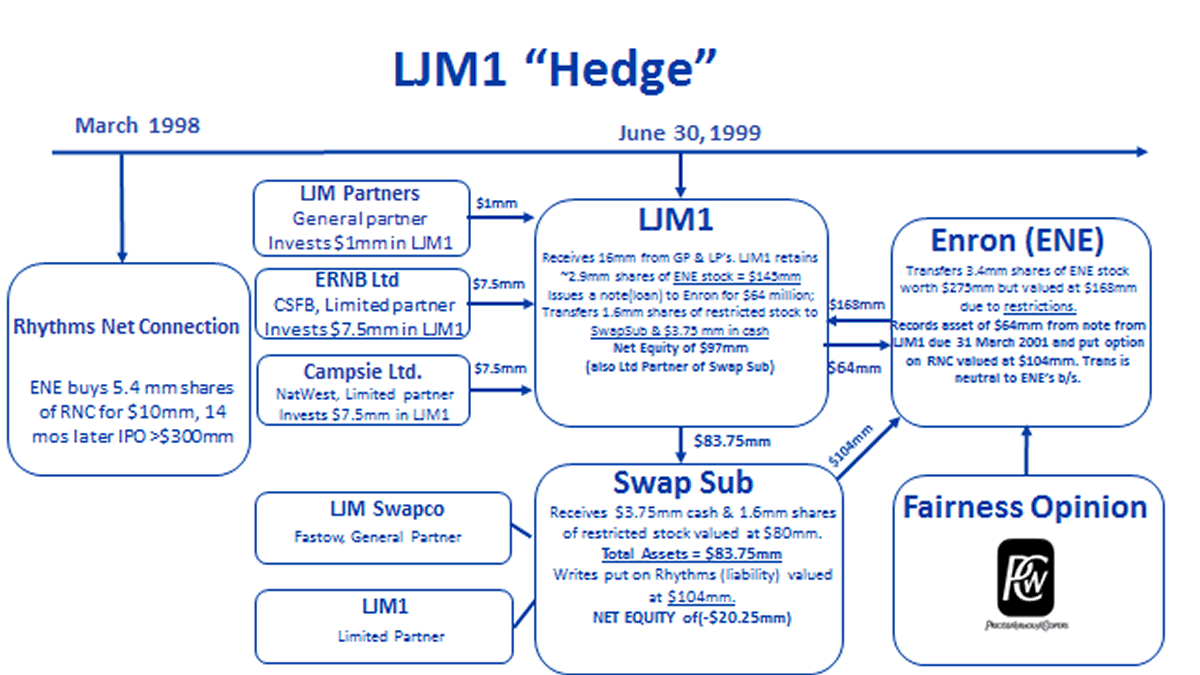

At the time of Enron’s collapse, it had as many as 3,000 SPEs. While I wont get into the nuances of how the SPEs operated, here is a picture of one such scheme:

On its face, LJM1 is “hedging” against the possibility of a decline in the Rythms Net Connection stock price. In reality, LJM1 was “temporarily” pulling hundreds of millions in losses and debt off of Enron’s books to hide from Wall Street analysts.

Collapse

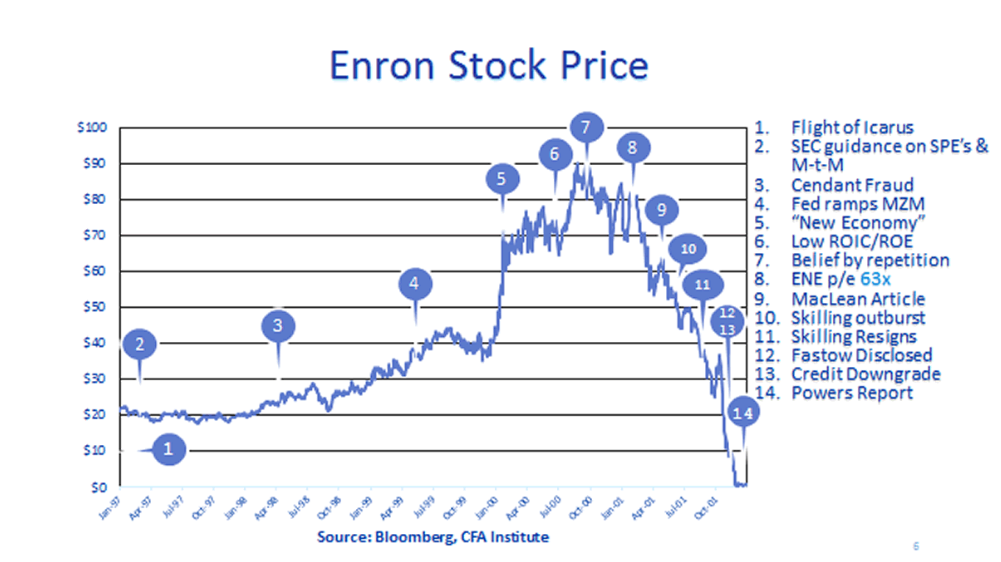

In late 2000, a short seller began to seriously question many of the footnotes Enron filed with the SEC, tipping off a Fortune reporter to possible issues. On March 5, 2001, Bethany McLean (eventual author of Smartest Guys in the Room) published the article “Is Enron Overpriced?” questioning how Enron was able to maintain its high stock value when most analysts weren’t truly certain about how they made their money.

As the pressure on Enron increased, cracks began to show. The CEO, Jeff Skilling, began to wear under the pressure, coming unglued on earnings calls when pressed for specific answers regarding Enron’s financials. On August 14th, 2001, Jeffrey Skilling suddenly announced that he was resigning from his role as CEO of Enron. This shocked the world. Why would one of the most powerful CEOs in the world, just 6 months into his new role, resign?

While some hoped Skilling’s resignation would create upward momentum for the stock, it simply continued its slow decline. The declining stock is critical, because Enron’s CFO had collateralized the Special Purpose Vehicles (SPEs) against Enron’s stock. For example, if Enron’s stock fell below $50, the SPE would fall apart and require immediate cash payment. With enough SPEs and a declining stock price, Enron was suddenly surrounded by ticking time bombs.

In October 2001, Enron restated its profits from 1997 to 2000, reducing earnings in the period by 23% or $613 million, shocking Wall Street Analysts. If Enron was 23% off on its earnings estimates, what else had they failed to properly estimate? In reality Enron was simply shuffling deck chairs around to paper over the massive losses it was incurring from exploding SPEs.

On October 31, 2001 the SEC announces an investigation into Enron’s SPEs, further tanking the stock price. On November 8th, Enron further revises its earnings to account for an additional $586 million in losses. Over Thanksgiving in 2001, Enron sought to sell itself to a rival, Dynegy, for $8 billion. Even this infusion of capital wasn’t enough, Enron was facing up to $13 billion in debt after all the SPEs came due.

On December 2nd, 2001, Enron declared bankruptcy. Over two months, Enron crash from $30 billion to $0.

FTX:

Crypto-Enron

As I write this, the pieces of FTX’s implosion are being picked up. Sam Bankman-Fried, the cofounder of FTX, is tweeting and hurriedly deleting as many tweets as he can. When Enron exploded, Jeff Skilling managed to stay out of jail for nearly five years. There is so much rubble to sift through.

Despite this, the parallels between Enron and FTX are obvious.

The Founding

Sam Bankman-Fried (SBF) is the now 30-year-old founder of both Alameda Research and, later, FTX. Prior to founding Alameda, SBF graduated from MIT and worked at a well renowned hedge fund on Wall Street (Jane Street). SBF is a vegan and an avowed Effective Altruist, meaning he was earning as much money as he could so that he could give it all away.

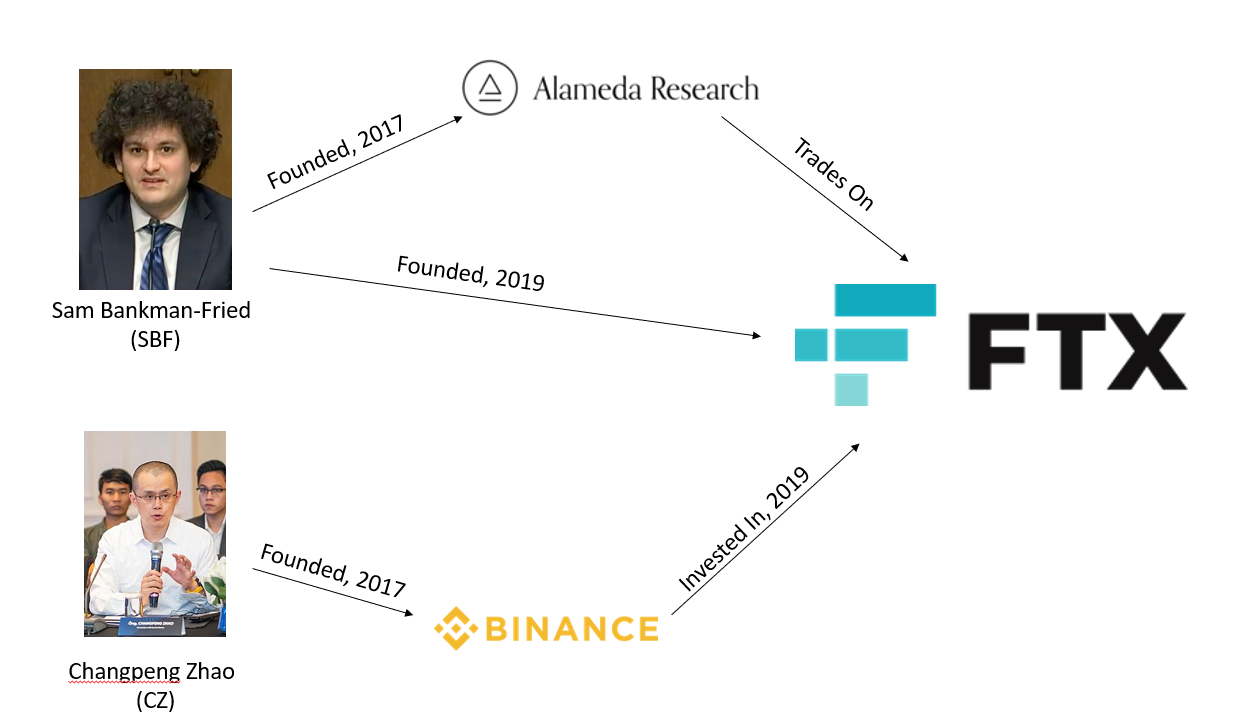

After spending time as a wiz kid Wall Street analyst, SBF noticed the profound uptick in Bitcoin and decided to create a crypto hedge fund to translate his Wall Street acumen to the space. Alameda Research was founded in 2017 to take advantage of the different prices of Bitcoin around the world. For example, relative to prices in the U.S., Bitcoin traded at 30% higher in Korea and 10% higher in Tokyo due to local laws and regulations. After overcoming a few obstacles, Alameda Research made millions of dollars by purchasing Bitcoin in the US and selling it in Japan. Eventually, this trade was discovered by others and so the window of opportunity closed, forcing SBF and his partners at Alameda needed to do something with all the money they made.

Officially incorporated in April 2019, FTX was a digital asset exchange built buy traders for traders. For the majority of its lifetime traders could place bets at 100x leverage. In contrast, the Federal Reserve Board’s Regulation T limits exchange leverage at 2x (2). In an August 5, 2021 interview for the podcast OddLots, SBF outlined how FTX was able to maintain this leverage because their liquidation engine – the method to take someone’s money if they make a bad bet – was just better than traditional finance!

While most of the funding for FTX came from Alameda and SBF, they also received outside support from Binance, another digital asset exchange, and its founder, Changpeng Zhao, or CZ. Binance/CZ invested $100 million for a 20% stake in FTX. This relationship will be important later, so here’s an illustration to help clarify the relationships:

In what was later an obvious red flag, SBF retained control of both Alameda and FTX, spinning it as a positive instead of a clear conflict of interest. In a profile by Yahoo Finance, SBF states that “Alameda has the same market access as any other entity trading on FTX. It doesn’t have special access to data, and goes through the API like others do.” (3)

The Come Up

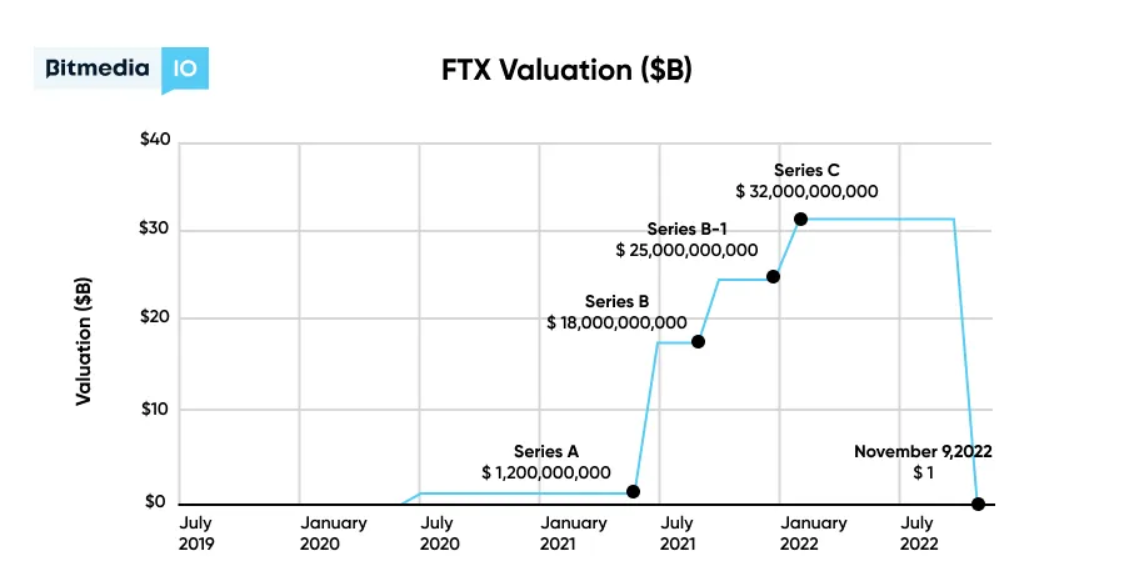

After its early seed investment from Binance and others, FTX’s valuation exploded during the COVID-19 pandemic:

In Fall of 2021, FTX was becoming a competitor with Binance. CZ wanted to sell his stake in FTX, so SBF bought back the now $2 billion valued stake. While portions of this deal were financed in cash, at least 25% of it was in FTT, FTX’s native token. We’ll circle back around to FTT, but remember that in the fall of 2021, Binance acquired $500+ million in FTT.

After his meteoric rise to become the world’s youngest and fastest multi-billionaire, SBF began deploying funds to clean up the image of crypto. For example, FTX deployed more than $300 million in marketing to “make crypto cool.” This included funny Super Bowl ads with Larry David:

Prominent MLB Sponsorship Placement:

Multiple advertisements with Tom Brady, including this weird cameo:

Ads like the following all over the world:

In addition to SBF’s marketing and sponsorships, SBF received glowing coverage from journalists. Instead of being a Bitcoin or Dogecoin bro, he was progressive, he was vegan, he was trustable! Vogue ran a major story on SBF’s philanthropy (4). Politico ran an article titled “Crypto’s strange new respectability.” (5) Videos were created on how he was the most generous billionaire (6). In their article on the collapse of FTX, the New York Times failed to use the word “fraud,” instead focusing on how tragic it was that he would no longer be able to give away his money (7).

DC Push

In addition to the glowing media reviews and paid marketing, Sam Bankman-Fried came from the right background and ran in powerful circles.

- Both his parents are law professors at Stanford (Joseph Bankman and Barbara Fried).

- His mother ran a large Democrat super PAC called Mind the Gap (resigned following FTX collapse).

- SBF was the second largest donor to Joe Biden’s 2020 campaign (8)

- The Father of SBF’s right-hand woman (Alameda Research CEO Caroline Ellison) is the head of the economics department at MIT.

- Gary Gensler, the current chair of the Securities and Exchange Commission, worked for Caroline Ellison’s father as an economic professor at MIT.

On December 8, 2021, SBF testified before the House Financial Services Committee in one of the first major hearings on blockchain (the Energy and Commerce Committee held its first in 2016)

The Crypto world fell in love with their loveable, dorky, math genius founder who couldn’t even figure out how to tie his dress shoes:

Telegram with the high quality SBF content pic.twitter.com/TLOLPuCQjQ

— Zack Seward (@zackseward) December 8, 2021

Through 2022 SBF became a larger and larger player in the DC ecosystem. He gave bipartisan closed door briefings to Members of Congress and their staff. He hosted (legally compliant) happy hours for staff to come and learn about crypto. He began hiring a ton of consultants and lobbyists, including former members and CFTC commissioners. At FTX’s May 2022 conference, Bill Clinton and Tony Blair appeared on stage with SBF (9).

Sam Bankman-Fried’s DC efforts culminated in his push to get the Digital Commodities Consumer Protection Act (DCCPA) signed into law by the end of 2022. On December 19, a draft of the bill was leaked and promoted on cryptotwitter, causing an uproar (10).

Here's a fun one people aren't noticing:

— Richard Chen (@richardchen39) October 13, 2022

SBF quietly lobbying to get the Digital Commodities Consumer Protection Act (DCCPA) bill passed which gives the CFTC power to kill DeFi but benefits FTX https://t.co/QKSLhxd0zl

On October 19th, SBF tweeted a 3,700-word policy framework attempting to calm the mob, but they just got even angrier (11). Sam, not used to being on the bad side of twitter, become somewhat unglued, ultimately tweeting the following insult at his former investor, CZ:

CZ is wanted by the Department of Justice in connection with money laundering for the North Koreans and sanctions evasions for the Iranians, so, no, he wasn’t allowed in DC. As portions of the crypto community turned on Sam Bankman-Fried for trying to kill DeFi, it’s rumored that an angry software engineer leaked Alameda Research’s balance sheet to the press, setting off something no one expected.

The Fall of FTX

On November 2nd, CoinDesk published the balance sheet of Sam Bankman-Fried’s hedge fund, Alameda Research. It showed that Alameda, while having more assets than liabilities, was seriously locked in illiquid assets, especially their native token, FTT (more on that later). This meant that if someone wanted to, they could give the hedge fund push to take a chunk out of Sam Bankman-Fried and FTX.

Enter stage right: Binance’s CZ.

Binance and FTX were growing rivals. CZ and SBF had a prickly relationship. SBF had just supported the Digital Commodities Consumer Protection Act, a bill which would have serious implications for CZ’s business. And, just four days prior, SBF had publicly shamed/made fun of CZ on twitter.

Remember, in 2021 Binance acquired $500+ million in FTT, enough to take SBF down a few notches. On November 6, CZ tweeted the following:

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

SBF tried to calm the market by tweeting “FTX is fine. Assets are fine” (12) and stem the bleeding by offering to purchase the FTT at a price of $22 each. It wasn’t enough, a 1929-style bank run had already begun. Over 48 hours, FTX customers withdrew $6 billion in assets. Two days after CZ’s tweet, on November 8th, FTX halted withdrawals. Three days later, on November 11th, FTX filed for bankruptcy.

What We Think Happened

Again, a lot of this is speculation but this is the story as we know it so far:

- In June of 2022, Terra, an algorithmic stable coin, blew up in spectacular fashion. It’s founder, Do Kwon, is currently wanted by South Korean authorities for fraud.

- When Terra blew up, a bunch of other blockchain companies blew up as well. This includes 3 Arrows Capital, Celsius, BlockFi, and Voyager.

- In hindsight, it appears that Alameda Research blew up at this time as well.

- Instead of letting his hedge fund blow up, Sam Bankman-Fried transferred (stole) customer funds from FTX to Alameda to keep it solvent.

- Alameda goes on a buying spree, purchasing BlockFi and Voyager for pennies on the dollar not out of altruism, but to paper over their massive losses. You don’t have to report massive losses if you own both companies!

- People begin saying SBF will be the next J.P. Morgan. SBF appears on the cover of Fortune magazine.

- Alameda’s illiquid balance sheet is leaked to the press allegedly because of SBF’s DC push for regulation.

- CZ, of Binance, sees this illiquidity and decides to take SBF down a peg by crashing the price of FTT, FTX’s native token.

- The crashing FTT price causes a bank run, resulting in FTX’s bankruptcy.

Summary: Alameda Research blew up in June of 2022 and SBF stole roughly $8 billion in customer funds to try to paper over the problem.

Analysis:

Comparing Enron and FTX

John Jay Ray III

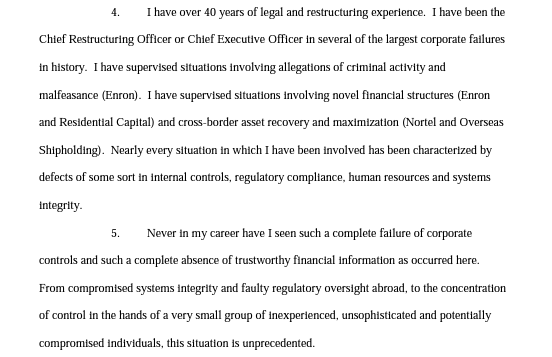

The first and most incredible comparison between Enron and FTX is that John Jay Ray III, the outside executive brought in to take FTX through bankruptcy, is the SAME person who took Enron through bankruptcy! You can’t make it up!

Scarily, Ray III said the FTX situation was the worst he'd seen in his career:

Structured Finance

On November 11th , FTX and 130 “related entities” filed for bankruptcy. This highly complex off balance sheet web of agreements is eerily similar to the structured finance deals cooked up by Enron’s CEO Andrew Fastow. Some of the deals were asset purchase agreements, while others were contribution agreements. Because FTX and Alameda were both privately held companies headquartered internationally, they had no transparency or reporting requirements.

The Smartest Guys in the Room has a quote along the lines of “whenever there is a new financial primitive, there will be people who use it to defraud and scam people.” For Enron, this new financial primitive was securitization and structured finance. For FTX, it was tokenization. In both cases, the liabilities and debt obligations were so obscured that neither company realized how close they were to bankruptcy until it was too late. That’s how you fall from $32 billion to zero in a few days.

FTT, Mark to Market, Likely Fraud

As mentioned previously, the FTX Token (FTT) was a token issued by FTX which granted holders access to additional features and kickbacks on the platform. While FTT held “value” for users of FTX, it was worthless outside of FTX. For this reason, FTX was responsible for buying back FTT and burning it when users wished to use their benefits. In this way, using mark to market accounting, FTX could easily manipulate the price of the token.

Here's how it would work:

- FTX creates FTT

- Alameda buys a bunch of FTT at a discounted price

- FTX burns FTT, increasing the market price

- Alameda posts the inflated FTT as collateral to “borrow” real customer cash from FTX

Returning to Alameda’s balance sheet, roughly half of its assets were FTT ($5.8 billion of 14.6). Alameda’s $5.8 billion in FTT was 2-3 times larger than the circulating supply of FTT. As FTX manipulated the price of FTT, Alameda could mark their assets to market at a higher value.

Enron did something similar with its off balance sheet SPEs. By collateralizing the SPEs, with Enron stock, the company was betting that their stock price would never go down. When their stock price did eventually decline, off balance liabilities began imploding. In many of the SPEs, the illiquid assets and liabilities were marked to market. On paper, the SPE said it was worth $100 million, but no one would be willing to buy it for that.

For FTX, by putting up FTT as collateral, they were similarly betting on their stock price. While FTX may say the FTT is worth $5.8 billion, no one would be willing to buy it for that amount. Once this was pointed out by CZ, people began scrambling to get their money out, causing the price of FTT to crash. As FTT crashed, loans which were collateralized against FTT became due, creating a crunch on FTX's cash. These sudden obligations, combined with the bank run, lead to FTX's bankruptcy.

Money Printer Goes -Brrr Until it Doesn’t

Making money is easy in an up market, it’s a lot more challenging in the down market. In March of 2000, the Dot-com bubble popped, sending the United States into a recession in 2001 (13). The 1990s were the longest recorded period of economic expansion in the history of the United States until July 2019 (14). These tailwinds helped propel Enron to the heights of its power.

In the same way, during the first year of the COVID-19 pandemic, FTX jumped from a $1.2 Billion dollar valuation (January 2020) to a $20 billion valuation (July 2021). In January of 2022, FTX was valued at $32 Billion, a 32x over 2 years! From 2020 to 2022, the Federal government spent more than $10 trillion dollars in COVID-19 relief. Americans received thousands of dollars in stimulus checks, many of which went directly into a semi-legal offshore quasi-casino called FTX.

In 2022 the United States entered a recession, and making money started to get a lot harder. Both children of the boom times, neither FTX nor Enron’s culture could adjust to the bust times. In a now infamous 2018 interview, the CEO of Alameda Research says they traded using “very little math,” that “comfort with risk was very important,” and that they “tend not to have stop losses, which aren’t a great risk management tool.”(15) In a March 2022 podcast with Tyler Cowan, SBF said that the reason he was successful is because he was always willing to flip a quarter for double-or-nothing. (16)

This high-risk, high-reward, deal making culture is a key component of what brought down both Enron and FTX. “Who cares, bet it all on red” is short-termism in the extreme. Cutting short-term deals and getting lucky on high-risk bets can only sustain a multi-billion-dollar business for so long.

DC Focus

Both Enron and FTX had a serious focus on regulation coming out of DC. Enron was pushing for the a favorable regulatory environment of natural gas and the federal electrical grid. FTX was pushing for a favorable regulatory environment for the trading of digital assets. In both cases, neither was able to achieve their desired outcome (Enron did not get the Federal Power Act repealed, the DCCPA is heavily opposed due its association with FTX.)

Clear Conflicts of Interest

Andrew Fastow, the CFO of Enron, sat on the board of LJM Associates, a PE firm which only did deals with Enron. In this way, he was negotiating against himself for the terms of deals. Further, employees of Fastow’s PE group would sit at desks inside of Enron’s headquarters. For many, it was difficult to tell who was working for which company and which moment. Crazily, this conflict of interest was reported in Enron’s public documents, but for a long time no one cared to look hard enough to see it.

In the same way, Sam Bankman-Fried’s hedge fund was trading on his exchange! This would never be allowed in the traditional finance world due to the extreme conflict of interest. While SBF said there was a Chinese firewall between the two companies, we now know this is not the case. SBF programmed in a ‘secret back door’ to transfer funds from FTX to Alameda without alerting other portions of the organization like risk management or legal. (17)

In both Enron and Alameda, clear conflicts of interest were present and publicly reported, but no one wanted to say anything because they too busy making money by ignoring it.

The Smartest Guys in the Room

Both Enron and FTX were famously smug. Here’s Chamath Palihapitiya recounting how they responded when he asked for increased diligence:

As I recounted above, when pressed in an August 5, 2021 episode of Odd Lots on how they could take huge risks without billions in capital, SBF functionally responded that they were just better than everyone else! FTX and Alameda rewarded high risk takers because they believe they could outsmart the market.

In the same way, Enron was famous for its meat grinder of rank and yank. In this system the lowest 15% of employees were fired each year. Further, Enron was famous for hiring the best from Harvard Business School, McKinsey, and Wall Street. To survive in this system you had to be arrogant and risk seeking. As mentioned above, the CEO of Enron Jeff Skilling believed he could beat anyone into submission through sheer brain power.

Unfortunately for Enron and FTX, while they may have been smart, they weren’t smart enough. Neither could out smart the market and ultimately imploded in spectacular fashion.

There you have it! The story of Enron, FTX, and the collapse of two business empires. In this time of flux, it’s important to remember that when Enron collapsed, we didn’t stop using natural gas to heat our homes. In the same way, in the wake of FTX’s collapse, we shouldn’t stop creating new products based on the blockchain. Fraud is fraud, blockchain was just the industry in which is happened.

Further, this story isn’t over! Enron collapsed in 2001, but Jeff Skilling didn’t go to jail until 2006. From 2001 to 2006, Jeff Skilling appeared before Congress numerous times as lawmakers sought to get to the bottom of what happened. I imagine something similar will happen with Sam Bankman-Fried and FTX (unless he flees to a non-extradition country like many other crypto bros on the run).

If you've made it this far, you should subscribe!

-Michael