The Crypto Pendulum

Growing up, my dad worked for Sound Diagnostics, an ultrasound company which contracted with large hospitals in our area. At one point, their largest hospital decided not to renew their contract and instead attempt to buy out all the employees. Losing this contract bankrupted the company and sent my dad into the job market.

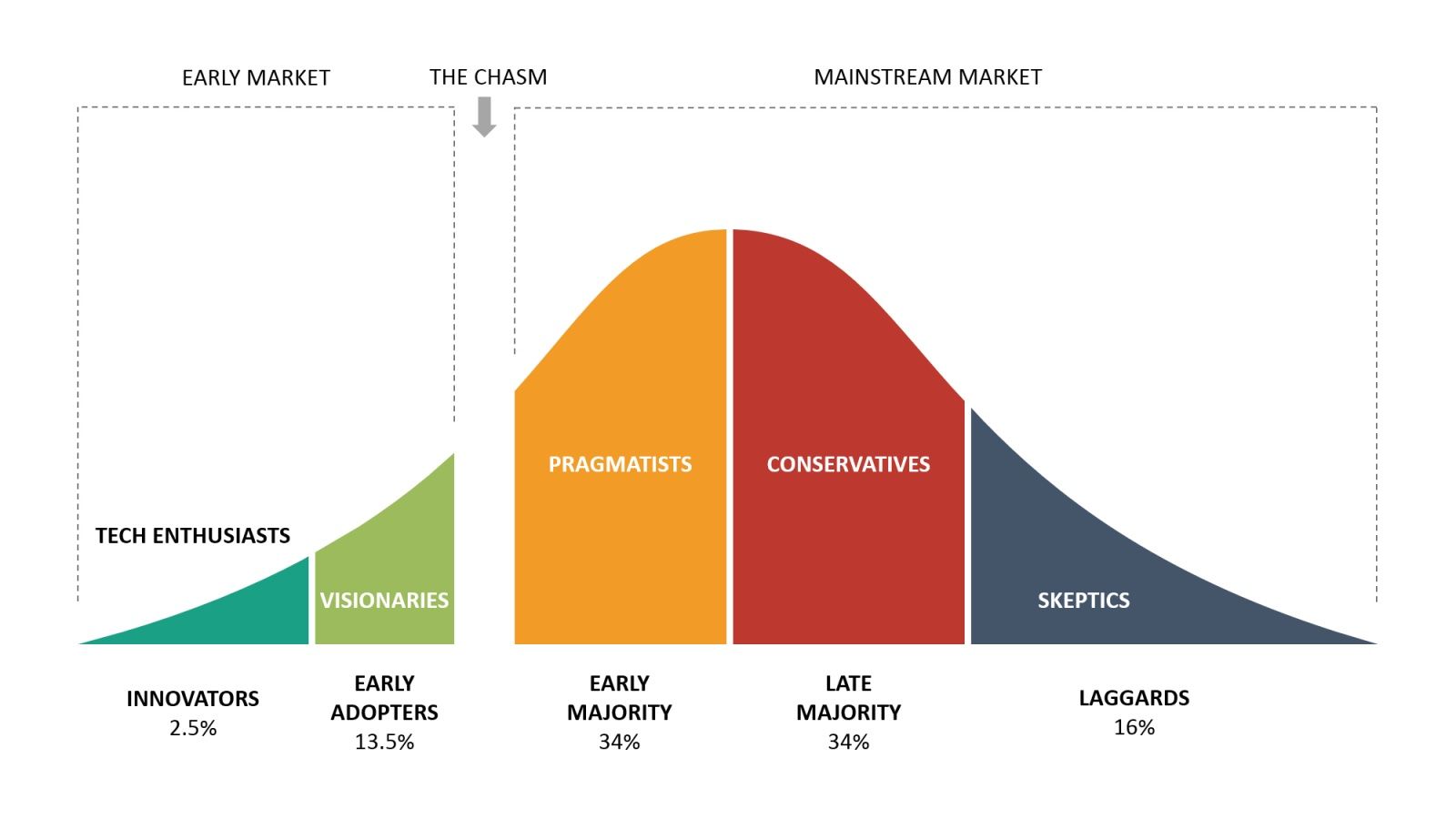

In this moment, my dad told me that centralization is like a swinging pendulum. At the hospital, the pendulum swung away from decentralized decision making, undercutting contractors like Sound Diagnostics. Centralization and decentralization are in tension, swinging organizations and economies from one pole to the other.

Blockchains are decentralizing force but they will not create the libertarian dream of Bitcoin’s earliest adopters. Instead, blockchain will unbundle many digital products and facilitate the development of new financial models and institutions.

Bitcoin Maximalists

Libertarian Dreams

I recently completed the book “The Infinite Machine: How an Army of Crypto Hackers is Building the Next Internet with Ethereum" and have been thinking through origin, goals, and founding ideology of blockchain.

While cryptocurrencies and blockchain have seen growing mainstream acceptance, the early Bitcoin community featured an intense anarchist or libertarian ideology. Satoshi Nakamoto’s Bitcoin White Paper, which created cryptocurrencies in 2008, centered on the idea of removing institutions from transactions. The earliest Bitcoin adopters were drawn to this ideology.

Bitcoin Maximalists, or “Maxis,” argue that Bitcoin and Proof-of-work are the only true, pure form of blockchain technology and peer-to-peer cryptocurrency. To Maxis, Bitcoin is an anti-institutional religion, not a fun new technology. True bitcoin believers remain an extremely committed libertarian group.

For example:

Coinbase – Coinbase, which now has a market cap of $54 billion, received serious pushback when it was founded. Coinbase started as a way to on-ramp mainstream users to Bitcoin, eliminating barriers to entry like a mining rig or self-custody of private keys. While reducing barriers, Coinbase also served as a centralizing institution – heresy to maximalists.

Ethereum Classic – One early Ethereum project was the Decentralized Autonomous Organization, or DAO. At the time, the DAO was the largest project attempted on the Ethereum blockchain, with a treasury peaking at $150 million in May of 2016. Unfortunately, the DAO’s code had a vulnerability which allowed a hacker to steal $50 million. This hack, while valid, was unethical and if successful would likely kill the fledgling Ethereum blockchain. To counter the hack, the Ethereum community “hard forked” the blockchain, rolling back the clock and returning funds to their rightful owners. This change, where the community determined not to acknowledge an unethical but valid transaction, incensed maximalists. A few days after the hard fork, maximalists created Ethereum Classic, a "pure" version of Ethereum which was never rolled back.

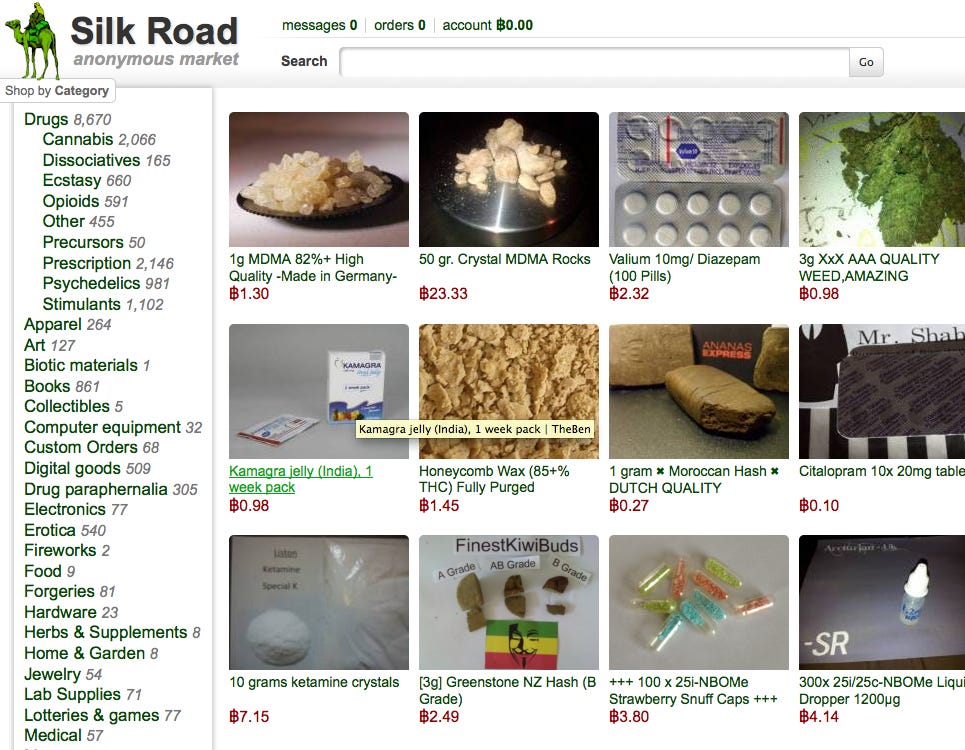

Free Ross DAO - Ross Ulbricht, also known by the pseudonym DreadPirateRoberts, was the founder of the Silk Road, an online black market for purchasing hard drugs, fake passports, or hitmen. The Silk Road was one of the first major uses for Bitcoin and helped demonstrate peer-to-peer currencies could be used to purchase goods. Amongst numerous other crimes, Ross Ulbricht assisted in the sale of millions of dollars of hard drugs and paid hitmen to assassinate his adversaries; he deserves to be in jail for a long time. In 2021, the Free Ross DAO is fundraising under the mission statement “Stand against injustice. Free Ross.” This is a perfect example of the libertarian streak of maximalists.

Maximalists oppose any form of institutionalization or centralization and view blockchain technologies as the best way to hedge against inflation and undermine traditional power structures.

Bundling and Unbundling

Rearranging the value chain

Jim Barksdale, the former CEO of Netscape, once famously said that “the only way to make money is bundling and unbundling.” Since its inception, the internet has been driving unbundling in multiple industries; blockchain can be understood as the latest iteration of this process. Chris Dixon of Andreessen Horowitz has the defining piece on the benefits of bundling.

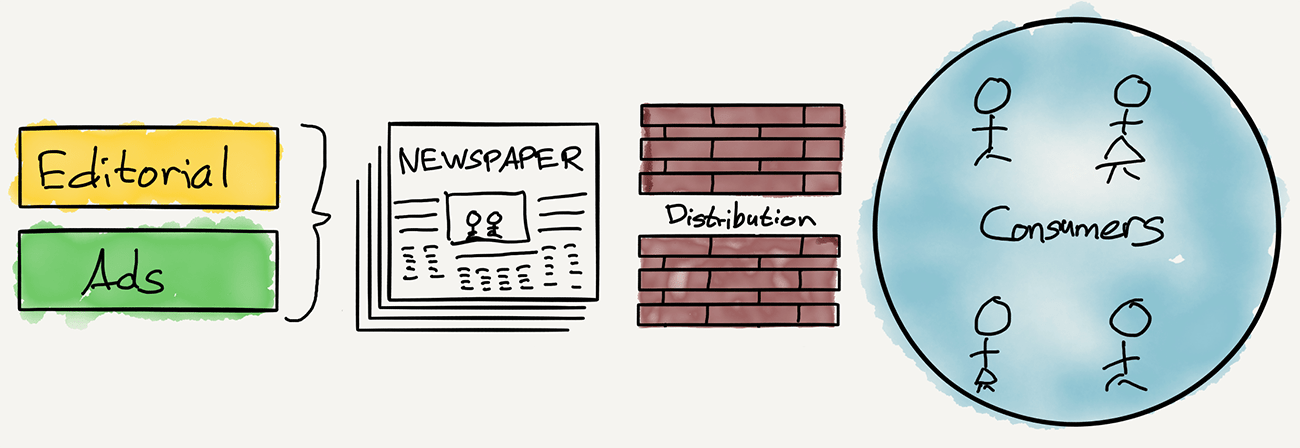

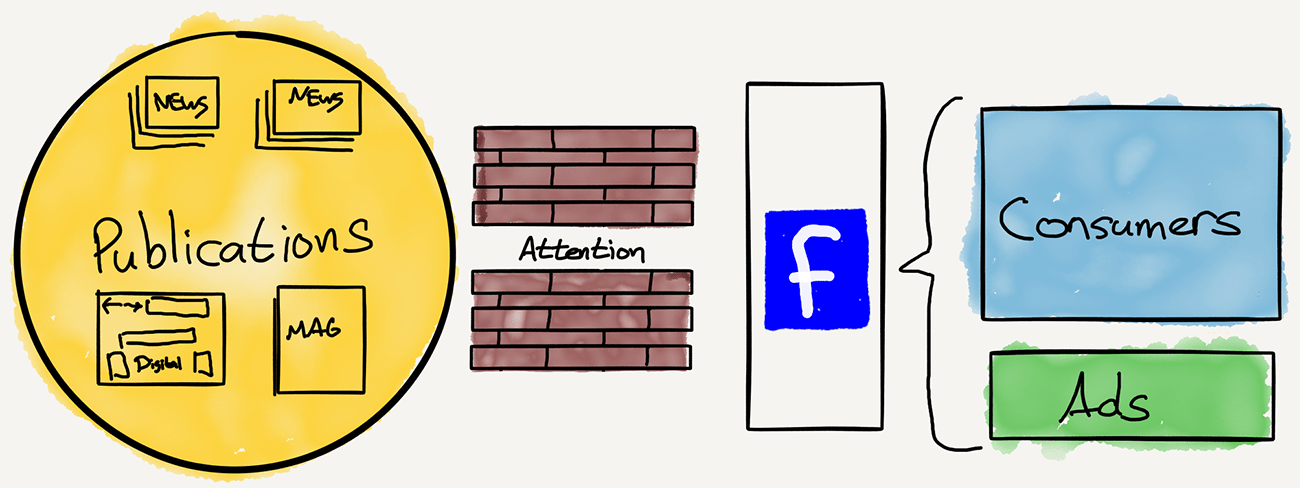

One of the most important aspects of the internet is the reduction of distribution costs to nearly zero. A clear example of this change is the decline of local newspapers. In the age before online media like Facebook, local newspapers carved out niches because they physically delivered a newspaper to a door. The newspaper contained local news stories, syndicated national stories from the Associated Press, advertisements, and local classifieds.

With the cost of distribution moving to zero, the constraining factor shifted from distribution to attention.

Just as print newspapers and retailers like Walmart were disrupted by the zero-cost distribution of the internet, financial norms and institutions are likely to be bundled and unbundled around blockchain.

Organizational Economics

Why do people form businesses?

In 1937, economist Ronald Coase published his paper “The Nature of the Firm,” which asked the question: why do people form businesses instead of freelancing their skills in the marketplace as an individual?(1) In the context of blockchain technology, the question can be restated: why do people create centralized institutions to conduct business?

The following two-minute videos clarify Coase’s ideas:

Businesses form because they reduce the costs of interacting with the market. To interact in the market, participants must:

- Find a customer

- Negotiate price with a customer

- Sign, monitor, and enforce a contract for said price

While the above is a bit abstract, it’s intuitive when you think of how you pay for goods every day. For example, say a neighborhood teenager offers to mow your lawn for $50. You counteroffer $40, you both agree to the price, and you hand the teen $40 with the agreement that they will mow your lawn the following weekend. In this instance, the teenager had to find you, negotiate the price, and fulfill the contract at a later date. If this teenager never shows up to mow your lawn, you are responsible for enforcing the contract, ensuring they hold up their side of the bargain. The above steps required for any market transaction, including when you haggle at a flea market or purchase a TV from a national retailer.

When freelance markets have lower total transaction costs, they beat centralized firms and vice versa. As I discussed in The Exponential Age, the costs of coordinating a large hierarchy can also slow growth. When the costs of coordination go down, forming a business becomes less necessary.

An underemphasized aspect of Coase’s theory is the importance of the incomplete contract, and by extension the property rights of firms.

A complete contract is one which accounts for all possible variables and outcomes. Unfortunately, complete contracts are not possible; the world infinitely complicated and the future is unknowable. If a complete contract could be created, residual property rights – within the business transaction – would no longer be needed; the two parties could simply write a contract which included asset ownership in all possible scenarios.

Firms, legal entities which exist until they are dissolved or bankrupt, provide stability to incomplete contracts. Should a contract break down as incomplete contracts often do, property rights revert to the status they existed in previously. Further, firms limit liability for employees, provide guardrails and boundaries for what is risked in a transaction. In the above example, if the teenage lawnmower fails to mow your lawn, you never pay them and they keep their lawnmower. If the teenager loses control of the mower and causes you physical harm, you could file suit and seek damages against the property of the firm, namely the mower.

No matter how smart a smart contract becomes, it will never be a complete contract. For this reason, we will always need some level of centralization.

What Maxis Miss

Most people aren't anarchists

While I am red-pilled on the revolutionary nature the technology underlying blockchain, I strongly disagree with bitcoin maximalists. Anarchism and extreme libertarianism remain on the fringe of political discussions because most people are comfortable with some level of centralization. Occupy Wall Street did not ultimately dismantle the world banking system in the wake of the Great Recession.

Blockchain will disrupt the financial system, bundling and unbundling services like zero-marginal cost distribution did to retail and local newspapers. In the early days, excitement around this disruption attracted anti-institutional developers who hoped the pendulum would swing from hyper-centralization to complete decentralization. However, as blockchain moves to the mainstream, this anti-institution ethos is fading despite maximalists’ best efforts.

The term “Web3” has quickly gained prominence as a catch-all term for blockchain products like cryptocurrencies and NFTs. The term received major pushback from bitcoin maximalists like the founder of Twitter, Jack Dorsey:

You don’t own “web3.”

— jack⚡️ (@jack) December 21, 2021

The VCs and their LPs do. It will never escape their incentives. It’s ultimately a centralized entity with a different label.

Know what you’re getting into…

The term “web3” couches blockchain technology not as a challenge to governments and financial institutions, but a new iteration of the internet.

Further, it is possible to win the battle but lose the war. Beginning in 1997, the so called “open source” movement aimed to shift the software paradigm towards a free, transparent model. The LINUX operating system and Mozilla Firefox browser are examples of open source software from this era. Similar to blockchains, the open-source movement was supposed to flip the software industry on its head and bankrupt companies like Microsoft.

Instead, companies like Microsoft and Apple adopted open-source platforms. (2) (3) Since 2017, Microsoft has been one of the greatest contributors to open source, with more than 4,539 code repositories publicly available on GitHub. (4) (5) Apple’s iPhone and Mac operating systems are built on open-source foundations. (6) Despite this, Apple’s walled garden app store and user interface remain the subject of Congressional hearings and anti-competitive lawsuits. (7)

Open source, the last “messiah” of decentralization, is now a foundational part of the large tech companies it sought to disrupt. Instead of rolling over and going bankrupt, Microsoft coopted the open source movement to provide a better user experience. In the same way, blockchain will not create a libertarian financial utopia.

Conclusion

A new internet, not a new printing press

Three key forces in determining the impact of blockchain technology:

- Firms continue to reduce the cost of transacting in the market

- Firms will fight for their survival

- Mainstream consumers are not anarchists

Blockchain is a revolutionary technology which will unbundle many modern institutions. However, because firms reduce transaction costs, institutions will continue to play an essential role in a blockchain-powered internet. For example, DAOs (Decentralized Autonomous Organizations) have begun to pop up as a digital-native successor to the LLC and are recognized as such under a new Wyoming law. (8)

Further, banks like Goldman Sachs are not static behemoths, but are composed of thousands of people, all of whom want to keep their jobs. Just as Microsoft coopted open-source software, legacy institutions will coopt blockchain technology. This cooption can already be seen:

- VISA invests in an NFT

- Sotheby’s accepts auction bids in Ether

- Nike purchases RTFKT, an NFT/metaverse company

- Ubisoft launches in-game NFT platform

Finally, consumers will not adopt decentralized technology for the sake of decentralization; there needs to be a compelling benefit. Most people do not want to store their life savings in their mattress, but instead prefer the ease, security, and safety of a bank. In the same way, most consumers will be uncomfortable with the idea that losing their private cryptographic key would erase their life’s savings. (9)

Audius, the largest blockchain-native consumer application, is a perfect example of where I think web3 will end up. Audius is an easy-to-use music streaming service modeled after Soundcloud. While interactions with the platform feel like interacting with any other website, the backend is built on blockchain. Audius’ catalog of streamable songs are all NFTs which pay the artist per stream. Further, all governance decisions for the company are made by a small group of $AUDIO token holders.

Roneil Rumburg, the CEO and Co-Founder of Audius, said in a podcast with Acquired that web3 is about “distributing ownership and building on the trust that comes with that.” He also said that people use Snapchat because of the impermanence, not because they use Google Cloud instead of Amazon Web Services on the backend.

Today’s internet, like much of the world, seems to be concentrated into the hands of a few large firms. While blockchain technologies will certainly rebundle much of the internet, because complete contracts are impossible, centralized institutions like governments and businesses will still be needed. The pendulum is swinging away from centralized institutions, but once all the energy is expended, the bob will be at equilibrium, not at either extreme.

If you’d like to hear the opposite side, the Bitcoin Maximalist take, I recommend the work of Balaji Srinivasan:

Or Anthony Pompliano

If you enjoyed this, I'd appreciate you sharing with your friends or subscribing by clicking the button on the bottom right. Thanks!

-Michael