The Fourth Industrial Revolution

Dr. Klaus Schwab, the founder of the World Economic Forum, published the Fourth Industrial Revolution in 2016. While many years have passed since its publication, the book stands as a thought-provoking forecast into our potential future. Many of the specific predictions of the book have not yet come to fruition, the general thrust of the book is accurate.

In general, Dr. Schwab accurately assesses the technical trends we should be watching. However, what those trends mean, and what we should do about them, that Dr. Schwab’s bias – a notoriously lefty economist – begins to show.

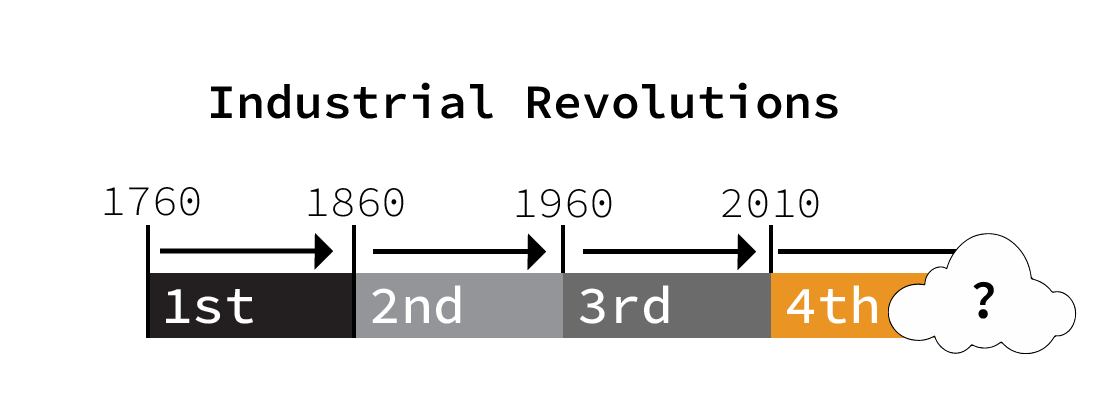

The book begins by outlining previous technological revolutions:

- Agrarian Revolution (~8000 BC) – Transition from foraging to settled farming

- 1st Industrial (1760-1860) – Mechanized production, the steam engine, railroads

- 2nd Industrial (1860 – 1960) – Mass production, assembly lines, electricity

- 3rd Industrial (1960 – 2010) – Electronics, computers, automation

- 4th Industrial (2010 – Present) – AI, Big Data, others

The central thesis of Dr. Schwab’s argument is that the Fourth Industrial Revolution will be radically different from previous revolutions because of its speed and scope. From this thesis he concludes that we, humanity, are not prepared to deal with the rapid changes which could come in the near future.

Facebook grew from zero to one billion users in eight years. TikTok, founded in 2016, did the same in five years. In contrast, it took the United States Government 50 years (1908-1958) and billions in investment to deliver electricity to under 50 million people. The internet allows for the rapid disbursal of innovative new technologies, many of which can be coded once and sold infinite times.

The central concern of Dr. Schwab’s is the impact the Fourth Industrial Revolution will have on the workforce. Advances in robotics, computers, and supply chains in the late 20th century automated away many blue-collar manufacturing jobs in America. Similarly, TurboTax automated the majority of personal accountants. The coming Industrial Revolution will eliminate millions of jobs and it is unclear what will replace them.

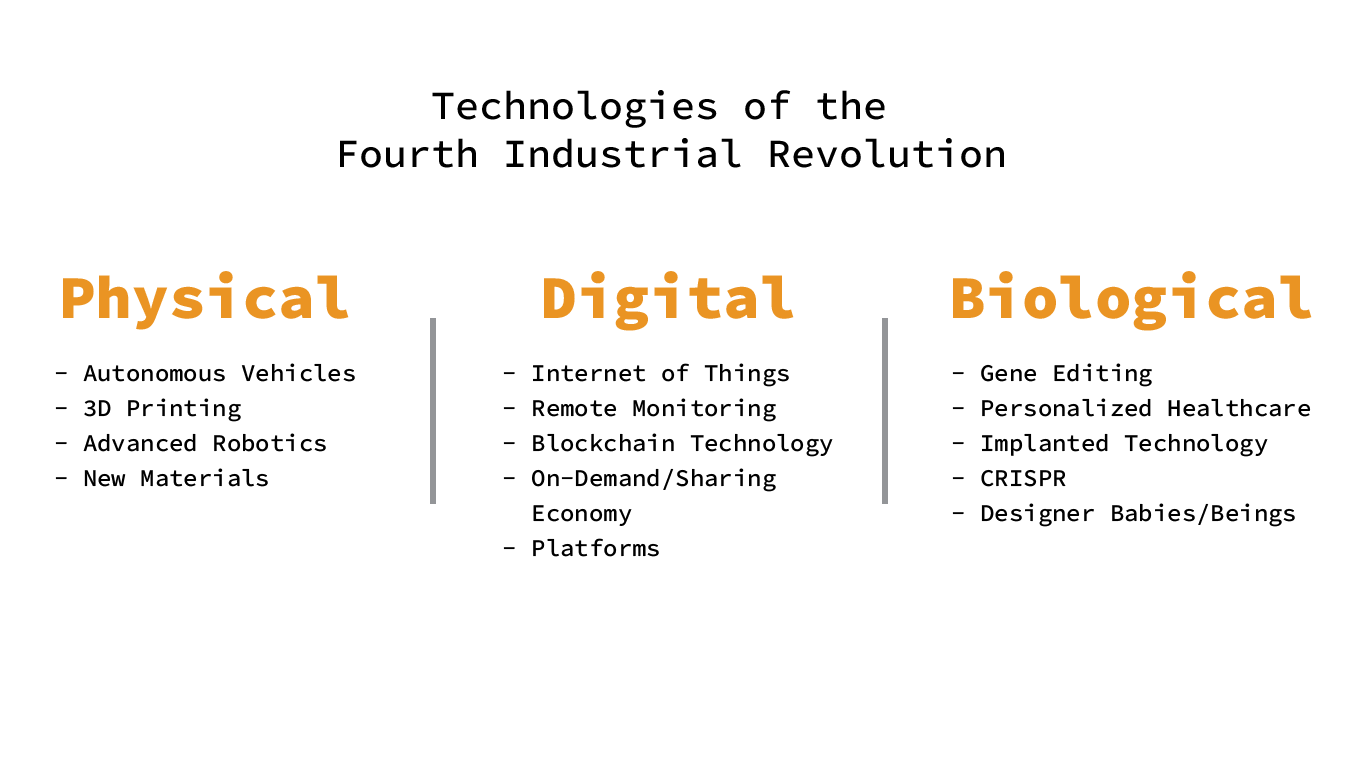

Dr. Schwab divides coming trends into three categories: Physical, digital, and biological.

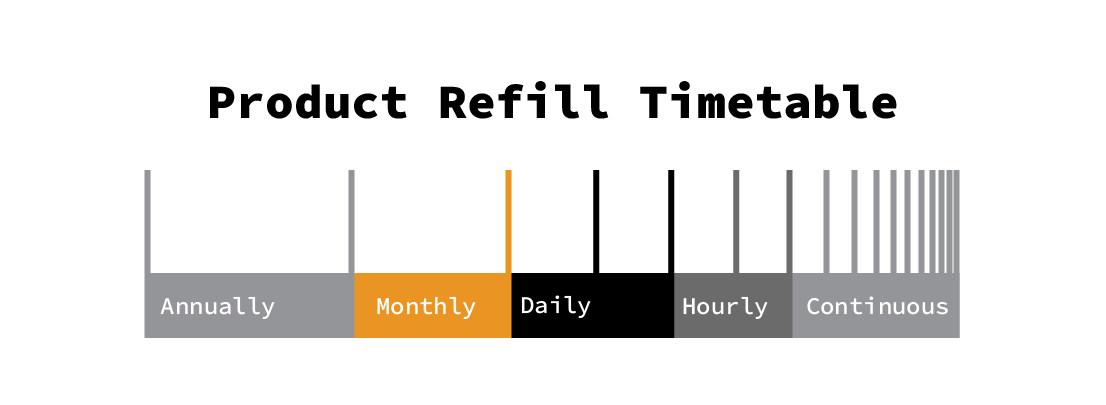

- Everything-as-a-Service – One of the larger trends in our economy is the movement towards “_____-as-a-Service.” Instead of a one-time purchase and installation of Microsoft Word onto a computer, Microsoft now offers Office365, a subscription model through the cloud. As sensors increase in capability, data grows in size, and AI become more adept at prediction, the timetable for estimating product failure will grow increasingly smaller. Dr. Schwab uses the example of tires on a long-haul trailer. In the future, a shipping company may purchase tires-as-a-service. With sensors embedded directly into the tires, the tire company can know exactly how many miles a tire is good for and automatically ship new tires as needed. Why purchase tires every 10,000 miles when you can pay a subscription service based on every 1,000 miles travelled? I plan to explore this trend more broadly in a future post as I think it will change consumer expectations and come to define our way of life.

- No Entry Points – Technology from the Fourth Industrial Revolution will also eliminate many entry level positions, both white and blue collar. Starbucks will have automated baristas. Banks will have more ATMs and automated loan processes. Entry level jobs - Data Analysts, Loan Officers, Marketing Associate, Internal Sales Representative, Cashier, Driver – are at high risk of automation. Eliminating these jobs will close pathways to gaining experience, closing off other jobs which require past experience. If there are no more jobs at McDonalds, how can a recent high school graduate demonstrate they will be a good employee? Automation may eliminate ladders upwards by eliminating inefficient jobs.

- White Collar Jobs and AI – Globalization and automation cost many blue-collar, middle-class Americans their jobs. These job losses – and the resentment they generated - have become a defining issue in American politics. We potentially face a similar scenario for White Collar jobs as AI becomes more capable. Why pay an editor $100,000 and benefits when an AI can just as accurately find grammatical errors? Why pay an insurance adjuster when an AI can scan insurance offers to find the best deal? Previously, an army of supply chain coordinators would move inventory around the country to ensure no shelf was bare. Now, Amazon uses an AI to predict and preposition products for their customers, eliminating most supply chain coordinator positions. This idea was the focus of another book I plan to write on, Futureproof by Kevin Roose.

- Changes to Aging and Consumption Habits – One subsection of the book focuses on aging and demographics. It states “the fourth industrial revolution provides us with the ability to live longer, healthier, and more active lives” and “…we live in a society where more than a quarter of the children born today in advanced economies are expected to live to 100.” In a world where 30 percent of the population lives past 100, does a retirement age of 65 still make sense? As work shifts from physical labor towards the information economy, this is likely to make even less sense. The section also points out that as the percentage of the population over 65 increases, the flow of capital will slow. The purchase of big-ticket ticket items such as homes, furniture, cars, and appliances will decrease as consumers age. Additionally, the intergenerational transfer of wealth – to consumers more comfortable with large, riskier purchases – through death and inheritance will decline as life expectancy increases. Millennials complain about the inability to purchase homes now, but there is potential the children of Gen-Z will face a steeper climb to access the capital Millennials have available.

- We Don’t Understand How Big The Internet Is – One quote which struck me was “240 million mobile internet users will join from Sub-Saharan Africa alone over the next five years. While certainly not as wealthy, this shift opens an entirely new market for internet companies and demonstrates the following: we cannot truly comprehend how large the internet really is. Axie Infinity, a Pokemon-style game built on blockchain, has 600,000 players – 60% of which are in the Philippines – and generate 1.1 billion in annual revenue. The largest YouTube channel is T-Series, a Delhi, India based entertainment company with 190 million subscribers. The United States has a population of 328.2 million – just 4.25% of the global population. For many on the internet, the largest barrier is language. If you have a product, there are sure to be thousands people somewhere in the globe who want to buy it; the internet is not zero-sum.

- Taking Advantage of Technology – One reason Dr. Schwab says he is still optimistic about the future is the failure of governments to integrate current technology. One of my favorite quips – not from this book - is that the US Government is a 19th century institution using 20th century technology to try to solve 21st century problems. The US Government must embrace new technologies or face ceding leadership to others who are willing to run the risks. For example, the People Republic of China is using AI and facial recognition software to oppress the Uyghur population in Xinjiang. Technology can be increase freedom and transparency but it can also be used to create a techno-authoritarian state which oppresses its people. Additionally, as the US saw with the 3rd Industrial Revolution, leadership during the time of change ensures wealth creation is locked into ones own country. Trillions in wealth were created by software companies based in the U.S. The US Government must take the lead to ensure the capture of wealth by our nation’s corporations and the enshrining of our values in the technical foundation of the future.