The Innovator's Dilemma

Clayton Christensen’s 1997 The Innovators Dilemma is the OG of MBA books. The ideas were revolutionary in 1997 and remain relevant 25 years later. Despite the best efforts of modern companies to address the trap, the book remain compelling because it highlights structural factors that are incredibly difficult to overcome.

Famously, Mark Zuckerberg is fearful of someone doing to Facebook what Facebook did to MySpace. This fear, of an innovative competitor emerging and rapidly overtaking the incumbents, is the basis of Christensen’s book. While a business book from the 90s may seem dry, this piece will eventually circle to explain the recent drama between Instagram and the Kardashians, so stay tuned.

Christensen outlines four factors that create the Innovators Dilemma:

- Companies Depend on, and Cater to, their Customers

- Small Markets Dont Help Large Companies

- Markets that Dont Exist Can’t be Analyzed

- Market Forces Inherently Create New Niches

The Innovator’s Dilemma is that businesses inherently sow the seeds of their own downfall when they successfully growing their business.

The Customer is Always Right:

No Customers, No Business

By their very nature, businesses exist to serve their customers. If you aren’t solving a problem, why should a customer pay you? At the end of the day, businesses sell things - products, services, information, etc. - to consumers. If a business isn’t listening to the needs of its customers, it will quickly lose their customers to a competitor and go out of business.

In my piece covering The Lean Startup, I discussed the idea of “product market fit.” This term describes when a product has found a niche, target customer for which the product solves a problem. Once a product niche is found, the product will be built in a way to solve the problems of that customer. The best companies are the best at satisfying their customer’s needs.

In contrast, disruptive technology companies solve problems that most customers aren’t aware they have. A famous example of this is Uber, who disrupted the Taxi industry. By using the mobile internet, Uber was not only able to capture the market for Taxis, but was actually able to expand the market to people who would never normally take a Taxi. Consumers were not asking for Uber to be created, but they loved it once they tried it. Uber created its own market by solving a problem with Taxis most consumers didn’t know they had.

Customers dont always know what they want, and the worlds best companies - who are the best at catering to customers - are trapped solving the problems of their customers.

The Law of Large Numbers:

Big Companies Need Big Opportunities

Big businesses need big opportunities to make a difference to their bottom line. If a $40 million company grows sales by $10 million, that’s 25% growth. If the $4 billion company only grew sales by $10 million, it’s hardly made any difference at all.

$4 billion + $10 million = $4.01 billion

People at large companies, even if they know they need to care about the potential opportunity, won’t be set up to care. No one will get a bonus for closing a $10 million deal if it means the overall company will miss revenue projections for the quarter.

Smaller businesses are excited about small opportunities in ways that large businesses simply can’t be. When a disruptive technology is just entering the market, working out the kinks, less customers will be willing to pay for it - they don't know they want it! Thus, the leader of a $40 million company will be excited to pursue a $10 million opportunity, while the leader of a $4 billion company will hardly notice the opportunity exists.

By the time the $10 million opportunity grows to become a $1 billion opportunity worth pursuit by the big guys, it’s too late - they’re too far behind to catch up. The company that dominated the $10 million market has had years to fine tune their product to solve new problems, and will continue to dominate the $1 billion opportunity as well.

Analysis Paralysis:

It Can’t Be Analyzed if it Doesn’t Exist

Market research, estimating the size of a given opportunity, is a critical component in decision making for large businesses with many opportunities before them. Investment dollars are limited and leaders rightly aim to spend those dollars in the most effective way possible. This drive for efficiency, to compare one opportunity to another, prevents large businesses from truly leaning into disruptive innovation.

For example, which opportunity should you invest $10 million in? Quantum computing, which may never be realized but could become a trillion dollar industry, or creating a more competitive bonusing structure for your sales team to attract top talent? Further, how do you evaluate this choice when your analysts have near certainty that investing in the sales team will grow your business by $40 million? It’s an easy choice - one in the hand is worth two in the bush.

This analysis requirement is why large businesses are excellent at sustained technological innovation but not disruptive innovation. Microsoft can reasonably analyze investments into its gaming division and the outputs it will produce. The Xbox One X, while radically more powerful, is roughly within the same paradigm of the original Xbox. Because the gaming market exists, Microsoft can work on expanding at the margins and making sustained, reasonable investments into its products.

The End is Always Near:

Your Success Creates Opportunities for Others

One important concept Christensen highlights is that businesses can actually create products that do more than customers desire. For example, why get the accounting software that’s $1000 with all the extra tabs and functions when you only need TurboTax for $100? The $1000 software is “better” but I dont need it!

Once needs are met from a functional stand point (this product does what I need it to) consumers begin to evaluate it on other factors. Specifically, consumers move in the following manner:

- Function

- Reliability

- Convenience

- Price

For example, if only one product does what I need, I dont have much of a choice. However, when multiple products can fulfill the tasks I need, I begin to evaluate based on which is the most reliable. When multiple products are functional and reliable, I shift towards convenience, and ultimately to price. Over time, all products (VCRs, USB drives, internet speeds, etc.) become commoditized, leading the most import factor consumers evaluate to be price.

Because of these dynamics, businesses have a limited number of product strategies:

- Push upmarket to higher-end, larger customers willing to pay for expert-level functions

- Stay with customers and move down the Performance, Reliability, Convenience, Price lifecycle

- Find a way to shift consumer demand to match technological growth (if small businesses need your product at the same rate you can improve them, you never need to move upmarket)

While any of the strategies can be effective, for most businesses, strategy one is the only sustainable path forward. Strategy two leads to the competing away of profit margins until there is little money to be made (1-2% profit margin). Strategy three, if a business can even achieve it, works for a limited time before succumbing to the product lifecycle anyways. When combined with the insights from the Law of Large Numbers, it’s easy to see why most businesses select strategy one.

For this reason, as businesses pursue strategy one and grow to meet the needs of large customers, they focus less on small businesses, creating an opening for disruptors. Disruptive technologies are “disruptive” because while they are initially used in small numbers, when they enter the mainstream, they quickly outcompete legacy products. This is how small, unheard of companies like AirBnb or Uber seemingly grow into goliath businesses overnight before their competition (Hotels and Taxis) can make a move.

The Meta Dilemma:

TikTok and Instagram

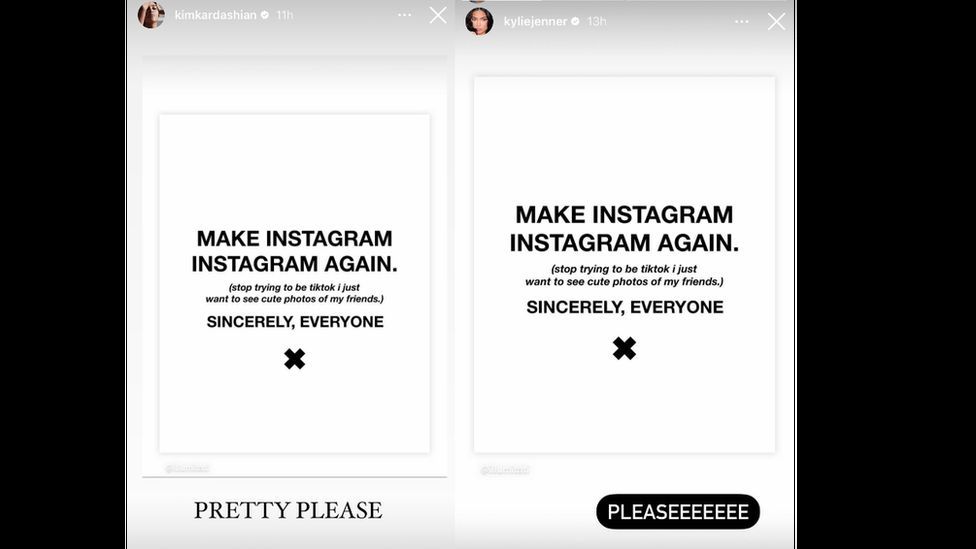

The Innovators Dilemma is perfectly illustrated by Meta’s recent scuffle with the Kardashians.

TikTok is currently eating Meta’s lunch. TikTok is the most downloaded app in the world, the most visited website, and boasts the most time on platform for any social media site (45.8 minutes per day vs. Instagram’s 30.1). 1 2 3

Facebook's hands are tied

— Nikita Bier (@nikitabier) February 2, 2022

1—High ARPU coastal users have churned; TikTok is eating their lunch

2—They can't acquire because of antitrust scrutiny

3—They can't build because founders don't want to be there

4—IDFA killed their ability to target ads

5—The metaverse is 10yrs out

RIP

TikTok’s innovation was to take the ‘social’ out of ‘social media’. Instead of primarily relying on your social graph to curate content, TikTok uses your social graph as just one factor in a hundred to determine what content to surface for you. TikTok is algorithm first, social second. This allows for content to go viral easily, as the algorithm can surface any content to anyone, anywhere.

To counter the meteoric rise of TikTok, Meta began to clone TikTok’s interface and algorithm and integrate it into Instagram, rolling out a test version to a number of users. 4 These changes caused an uproar from Instagram’s users, but especially from the Kardashians:

This backlash caused Instagram to walk back its changes. 5

Meta is between a rock and a hard place: if it changes to match TikTok’s innovation, its users revolt, but if it doesn’t adapt, TikTok will totally disrupt it. This is the Innovator’s Dilemma: Meta/Instagram is a very profitable business today because it has catered to its customers. However, because Instagram is so large, major changes to its products cause outrage amongst its users, blocking its ability to keep up with innovative new techniques. TikTok spent years refining its algorithm, and now that it’s entered the mainstream it will be extraordinarily difficult for Instagram to catch up.

The one area for optimism is Facebook’s pivot to the metaverse. Because of the challenges outlined above, Mark Zuckerberg is betting the entire company on a market that can’t be analyzed. Meta is investing $10 billion a year, for the next ten years, on metaverse-adjacent technology like VR headsets and sensors. Would Microsoft be willing to make a $100 billion bet, functionally betting the entire company, on a technology that may not pan out? What if, in 10 years, people dont want to do VR, and a different technology dominates instead? Meta would go bankrupt. Instagram is likely to lose to TikTok, so Zuckerberg is betting the farm that they can invent the next wave of innovation and avoid the next Innovator’s Dilemma.

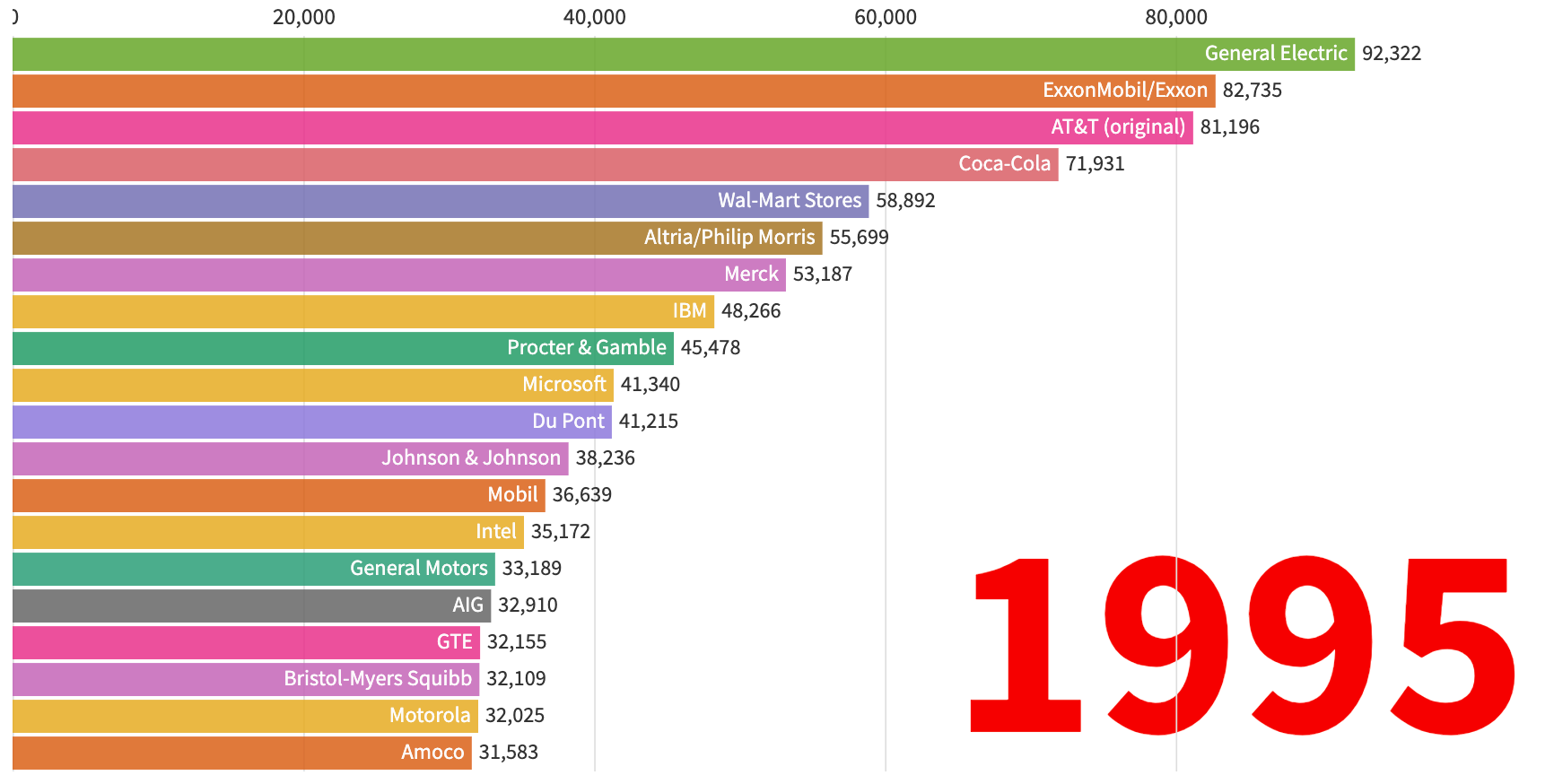

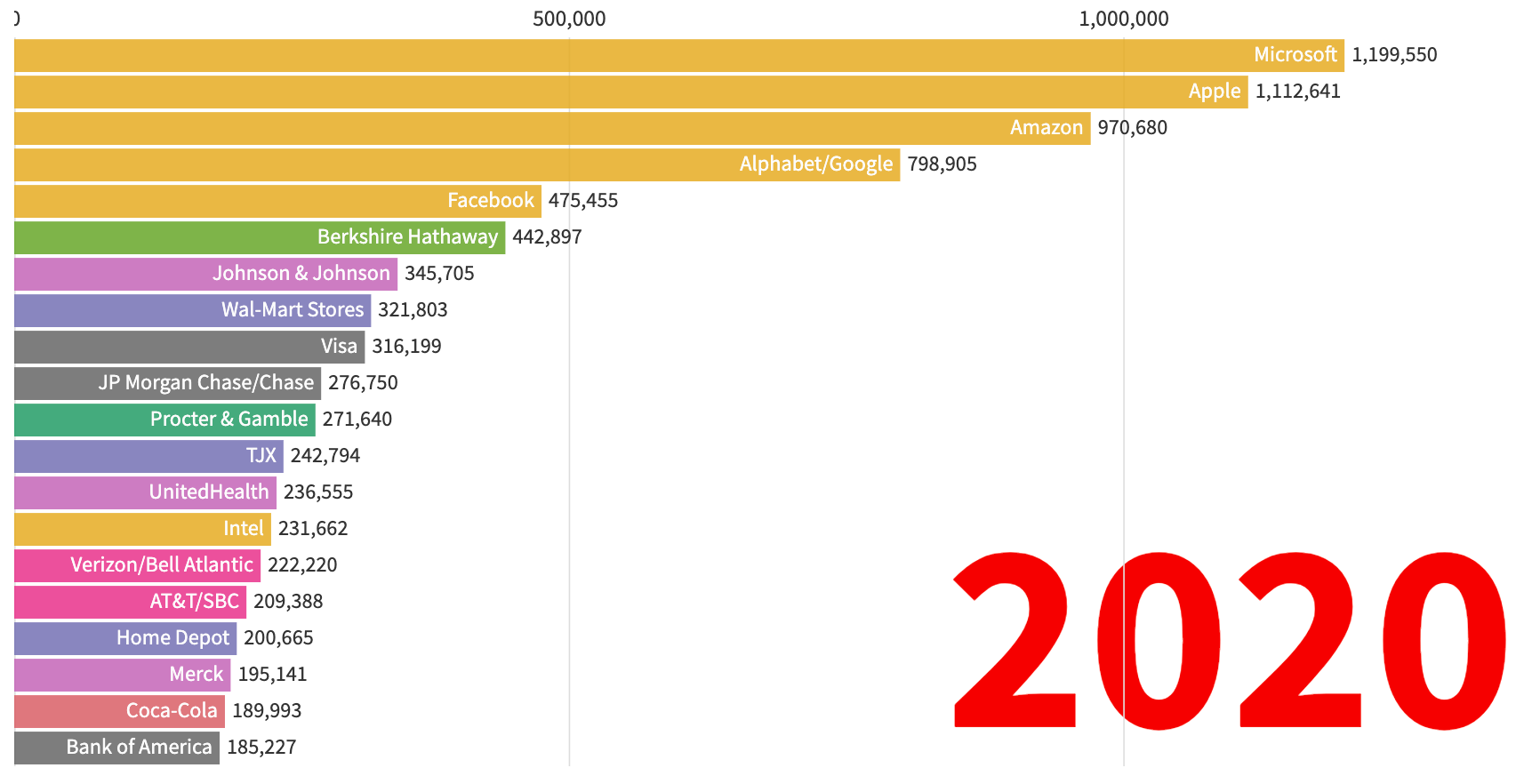

From 1995 to 2020, the world’s top five most valuable businesses have seen a complete changing of the guard. It's likely that in 2045 the top of the charts will feature different companies. There is a reason that IBM dominated mainframe computing, Microsoft dominated the personal computer era, and Apple dominates the mobile computing era. The Innovator’s Dilemma, even if you know it exists, is very difficult to avoid.

-Michael

If you've made it this far, you'll probably like my other pieces as well. Subscribe below for free.