On Chain - The Problem with Tokens

In this week's Not Boring. Packy McCormick highlighted something everyone in web3 knows is a problem - the user interfaces are terrible. Despite the wide recognition that today's highly technical user interfaces are a barrier to mainstream adoption, I believe there is actually a more fundamental problem with tokens.

Instead of a design or technical problem, it's conceptual. Most people believe that tokens are for users, but the truth is that tokens are actually for producers. At best, tokens create marginal utility for mainstream consumers. Instead, it's producers - content creators, software engineers, node operators - that are the target demographic which web3 projects should design for. To move the internet towards decentralization, web3 projects should hide tokens from all but the most advanced users and focus on creating more value than today's largest tech players.

If you like this article, share with your friends, and subscribe by clicking below:

Decentralization:

The Goal

By definition blockchains are:

- Decentralized: Transactions are stored on a network of computers (nodes).

- Immutable: Transactions cannot be changed once committed to the block.

- Open: Transactions can be viewed by anyone.

While each is important and deserving of examination, the driving force behind the shift to web3 is decentralization. While there are many benefits to centralized control (as I discussed in The Crypto Pendulum), there can be major downsides as well. The United States has anti-trust laws for a reason!

In the original Bitcoin white paper, Satoshi Nakamoto wrote:

Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust based model. A certain percentage of fraud is accepted as unavoidable.

“Decentralization” is a catch all term for created a trustless way to transaction with others. By removing trusted third parties, blockchain technologies aim to reduce fraud inherent in the interactions between various centralized systems.

The Primitive:

Decentralization Requires Tokens

In computing, a primitive is the smallest unit of processing available to a programmer, and can be thought of as the building block upon which all else is built. For technologies secured by a blockchain, the token is that essential building block.

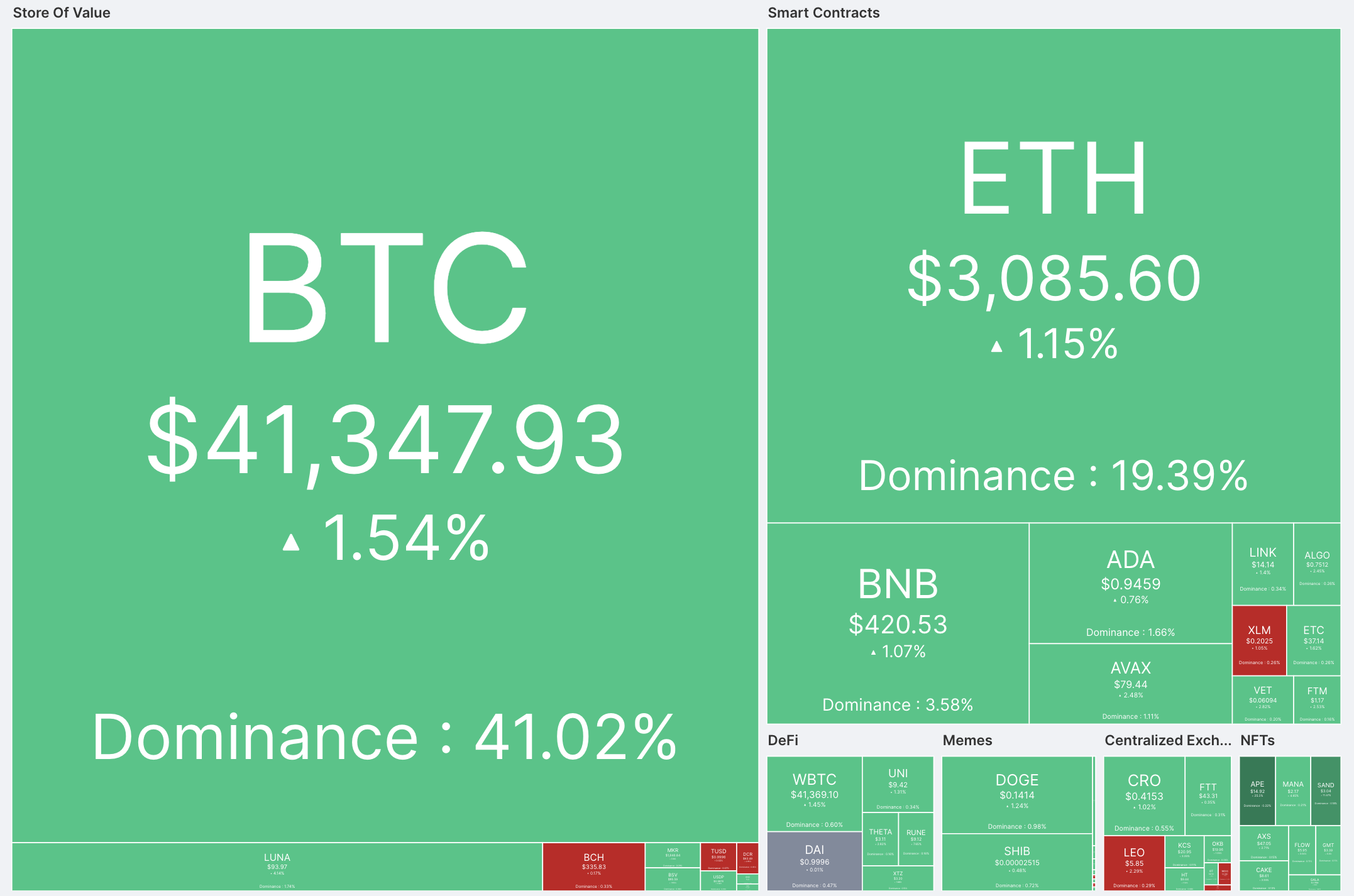

Blockchains, and the applications built on top of them, use tokens to secure their ledger against fraud. For example, miners who help secure the Bitcoin blockchain are paid in Bitcoin (BTC) for their work. The same is true of Ethereum, which pays those who secure it in Ether (ETH).

There are hundreds of different tokens, each representing a blockchain or application it helps secure. Without tokens, there is no way to create a trustless way to transact with others. No tokens, no blockchains.

Utility:

The Importance of Value Creation

Quick definitions:

Value creation - Anytime the benefits of an action exceed the costs. When a producer creates something of value.

Value capture - When a producer is paid for the value it creates. If a consumer receives more economic benefit than what they paid for, value is not captured.

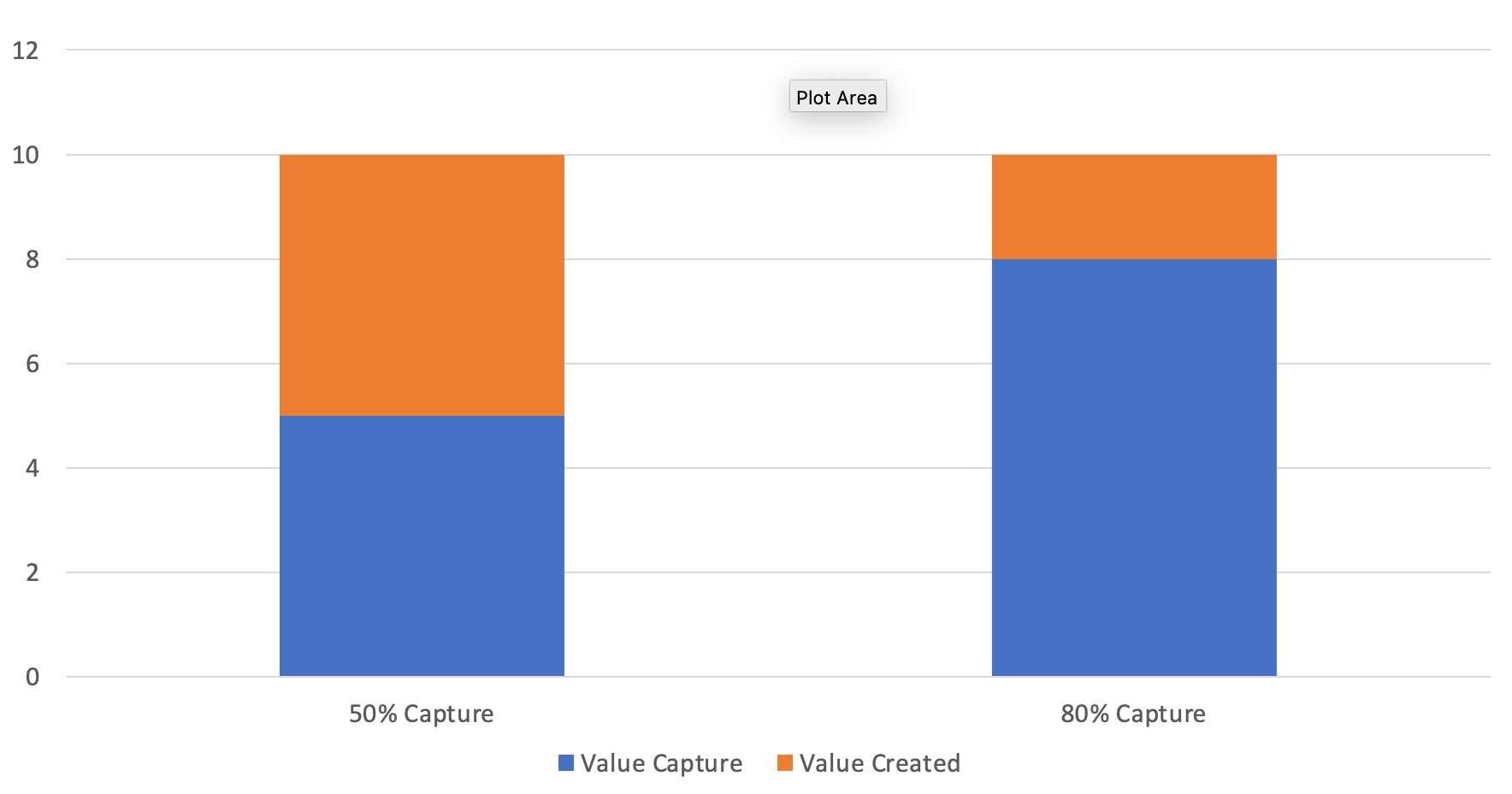

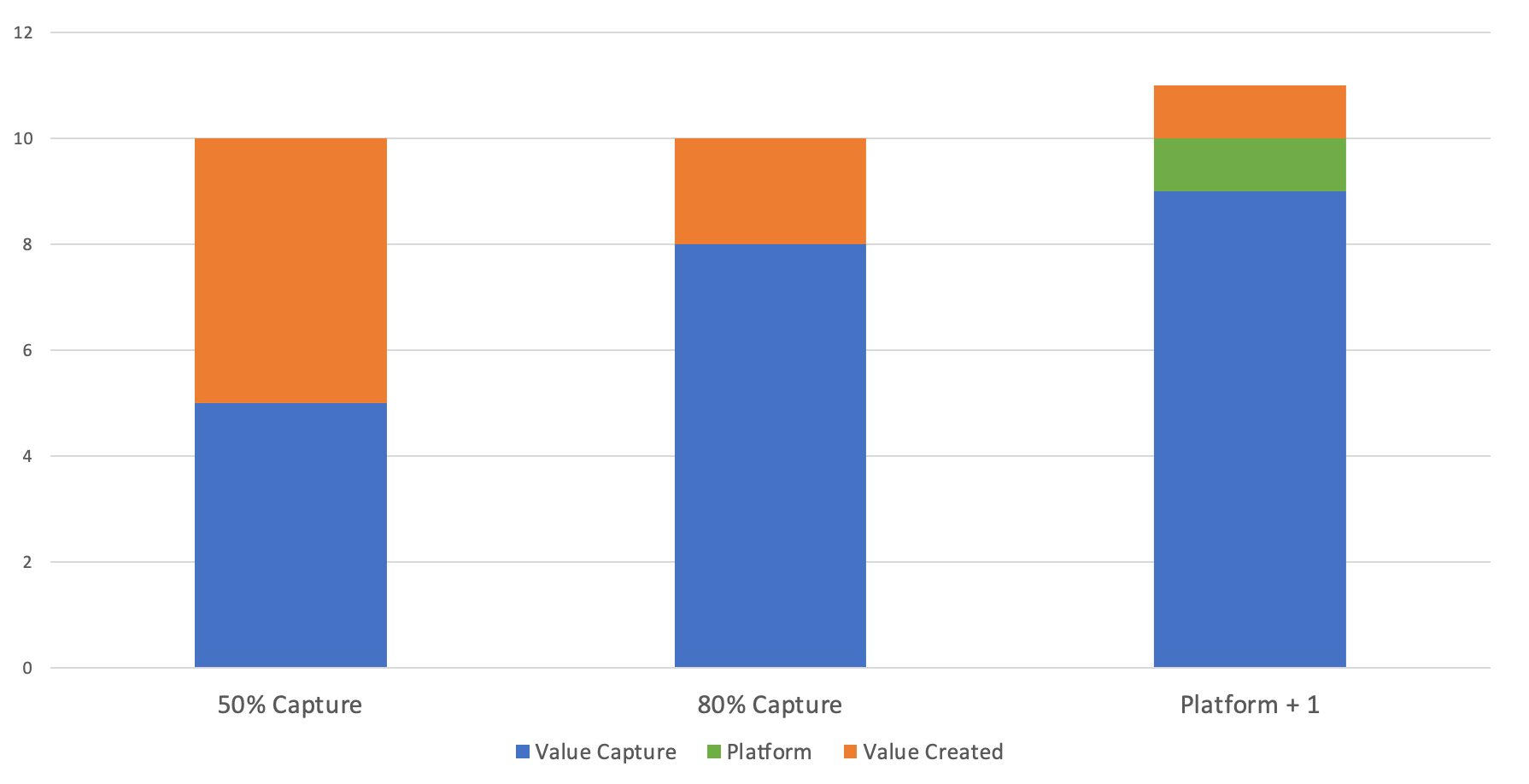

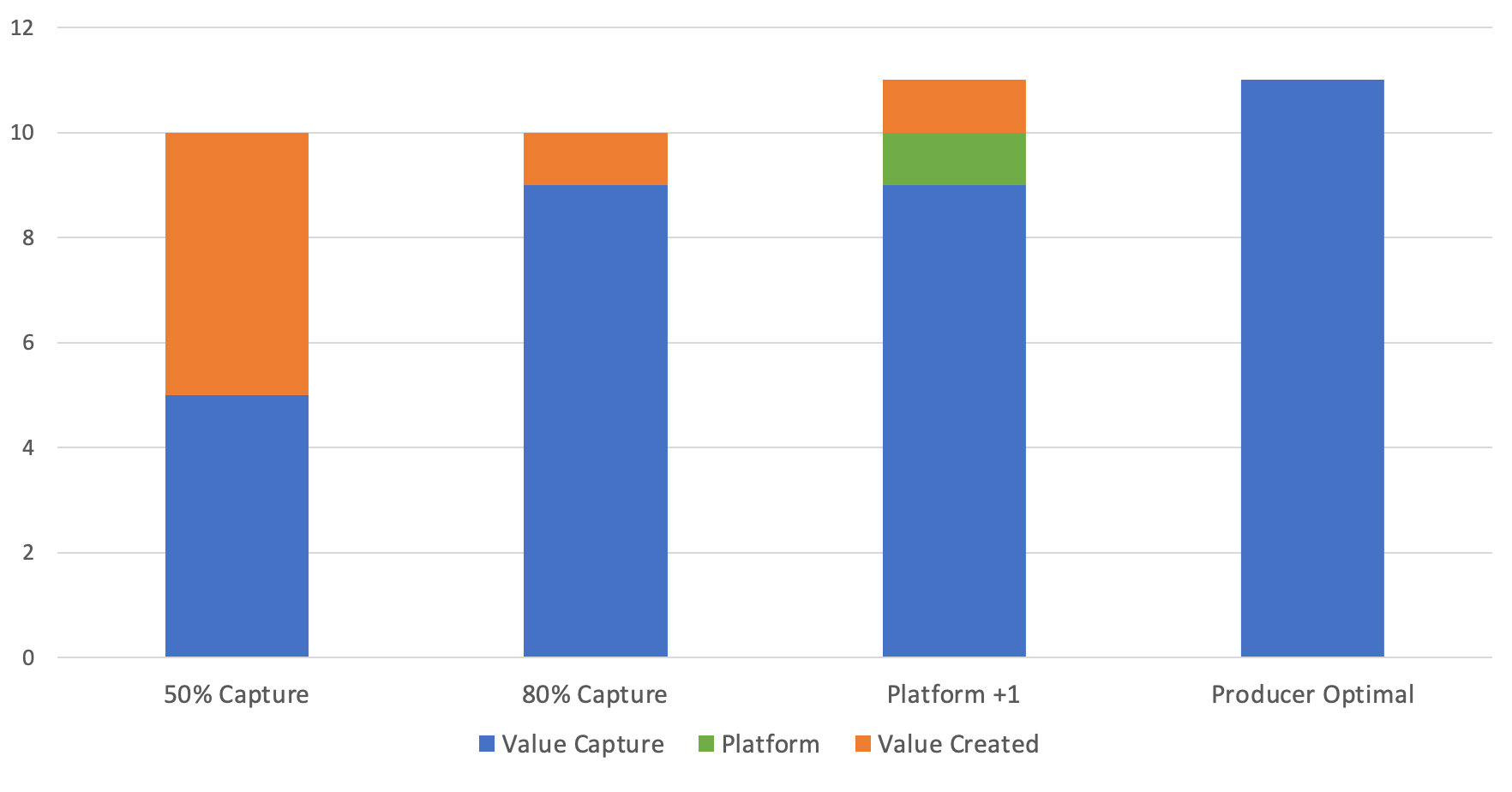

It’s important to note that for the above, producers are the key. The orange is money left on the table. If one business sells a $10 book and captures $5, they will eventually lose to the business which can sell a $10 book and capture $9.

The internet and e-commerce enabled businesses that were never viable previously. Amazon, for example, was built to take advantage of the long tail effect, where businesses benefit from selling less popular goods to niche audiences. Barnes and Noble or other physical book stores are limited by the number of books they can keep on their shelves, which leads them to prioritize the most popular items. In contrast, Amazon can hold an unlimited catalog of books, many of which may only sell 3 copies a year. By using the internet to scale, Amazon is able to serve personalized books to increasingly narrow audiences.

The long tail effect can be felt throughout the internet as businesses personalize their content to match niche audiences:

Netflix produces and serves a wide catalog of content which appeals to narrow audiences. I have never watched a cooking show on Netflix, yet enough people do that dozens of cooking shows are available to stream.

YouTube uses data it collects to personalize its recommendations to better match your narrow preferences. Most of T-Series’, the largest Youtube Channel in the world with 213 million subscribers, videos aren’t in English as their core viewership is based in India.

Spotify uses data from your listening history to surface niche songs targeted to your preferences. My 2021 Spotify Wrapped listed “Vapor Twitch” as my top music genre, something I think they made up to cater to my preferences!

This level of personalization has generated a lot of value. Today, it’s second nature to rely on Netflix, YouTube, or Spotify’s algorithms to surface content we enjoy. We don’t think about how the internet has enabled Amazon or eBay to carry a near infinite catalog of niche products, or how incredible it is that we expect those products to arrive at our doors within a week. Seven of the ten largest companies in the world (Apple, Amazon, Google, etc.) are tech companies because of the value they have created.

In the late 90s, companies like Yahoo started as portals to the internet. In contrast to AOL, which only linked to content they had created, Yahoo exploded in popularity by curating links and serving as a starting point to jump into the web. However, as the internet and e-commerce gobbled up increasing real world services, incentives flipped, and instead of sending users out to internet, portals needed to keep users on their sites as long as possible.

This shift to aggregating user content and demand led to the current tech paradigm: platforms. Facebook, instead of sending their users out to the web, displays status updates and news articles in feed, serving as a middle-man between users and content. Platforms, a complicated topic I’ll address fully another time, create a lot of value, but they also capture most of it. This is great, if you create value for consumers, you should capture it!

In contrast to platforms like Facebook (green) which are excellent at capturing the value they create, Craigslist is an example of how not to capture value.

Craiglist:

Failing to Capture Value

Originally developed as a digital version of local classified ads, the simplicity and transparency of Craigslist meant that there was no specific reason to use Craigslist over another product. Outside of a few select categories used to pay for server costs (job postings, by-dealer offerings, etc.) posting to Craigslist is totally free. Craigslist doesn’t take a percentage of any of the transactions which occur on its platform.

It’s estimated that despite stealing $5 billion in value from the newspaper industry between 2000 and 2007, in 2008, Craigslist only made $81 million in revenue - just 2%! This gap, between $5 billion and $81 million, spawned hundreds of companies. Many of today’s most profitable tech companies are simply sleeker versions of a Craigslist vertical. For example:

- AirBnb = vacation rental. AirBnb famously piggy-backed on craigslist to create its network:

- Uber = rideshare

- OfferUp = For Sale

- Indeed = Jobs

- Reddit = discussion forums

- Apartments.com = Apts / housing

When you take a closer look, it is astonishing how many companies capitalized on Craigslist’s failure to capture value. In broad strokes, these companies centralized a vertical of Craigslist, created a system to establish trust between users, and made an easy to use user-interface which reduced the barriers to paying for services.

For example, instead of replying to c553cte12ebd3e179b341d639@c.craigslist.org offering to drive you from Bellingham to Seattle, you call an Uber. When a car is found, you see that the driver has a 4.8 star rating, and your card or bank account are automatically charged when the ride is completed. Instead of hoping an anonymous internet user isn’t a serial killer, and that they happen to have change so you can pay them exactly the right amount for gas, Uber abstracts that all away, adding value.

Friction:

Tokens Add Barriers

As discussed above, tokens are the primitive unit of web3. To have a decentralized, trustless system, each blockchain and application requires a unique token. Instead of reducing barriers and creating trust, this slew of tokens does the opposite.

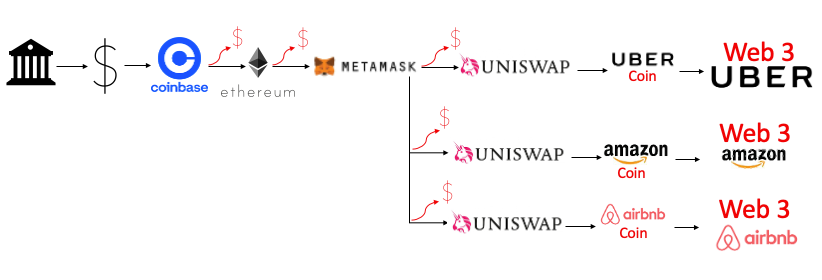

For each step in a transaction, users need to stop, swap tokens, and then proceed. Each time tokens are swapped, a small fee is paid.

As pictured above, to pay for a single “Web3 Uber” the consumer would need to conduct five separate transactions! A consumer would need to move money from their bank to an exchange, purchase an L1 token, pay to transfer the crypto to a wallet, pay to exchange the L1 token for the web3 Uber token, and then pay for the web3 Uber.

What happens if, at the end of this string of transaction, you dont have enough tokens to pay for the web3 Uber? Start over and repeat the process until you have enough tokens at the end.

What happens if you have too many tokens at the point of sale, and are left with 2 dollars worth of web3 Uber tokens after the transaction? Pay 15 dollars to return the value back to your bank or leave it stranded.

Further, for each service, this process will need to be repeated. Instead of reducing friction, tokens make commerce more difficult.

Contrarian Take:

Tokens are for Producers, Not Consumers

In his book, Zero to One, Peter Thiel (former CEO of PayPal and investor at Founder’s Fund) famously asks the Contrarian Question:

what important truth do very few people agree with you on?

A good answer takes the following form “Most people believe in x, but the truth is actually the opposite of x"

Most people believe tokens are for consumers, but the truth is that tokens are actually for producers.

It’s common, when discussing web3, to talk about how incentives will change. However, while incentives for technical experts and producers will change, mainstream consumers will continue to seek increased utility wherever they can find it. For web3-Amazon to replace today’s Amazon, it needs to provide more utility to consumers.

The problem is that while consumers care about value creation, producers care about value capture. Tokens and decentralization remove middle-men and third parties and allow producers to capture more of the value that they create.

Decentralization is the shining ideal of web3 and cryptocurrencies. However, the number of consumers who will join web3 based solely on this ideal has already reached its limit. Mainstream consumers are not willing to sacrifice the convenience of Amazon for an ideal like decentralization. Instead of selling decentralization to consumers, web3 must sell decentralization to producers.

Wherever the artists, writers, and software engineers are creating the best products, consumers will follow. The next 1 billion users will be onboarded because web3 provides better services, not because it is decentralized. Therefore, to get the best results for both groups, web3 must evolve to have simplified interfaces and payment rails over tokenized backends accessible to advanced users.

Audius:

Party in the Front, Tokens in the Back

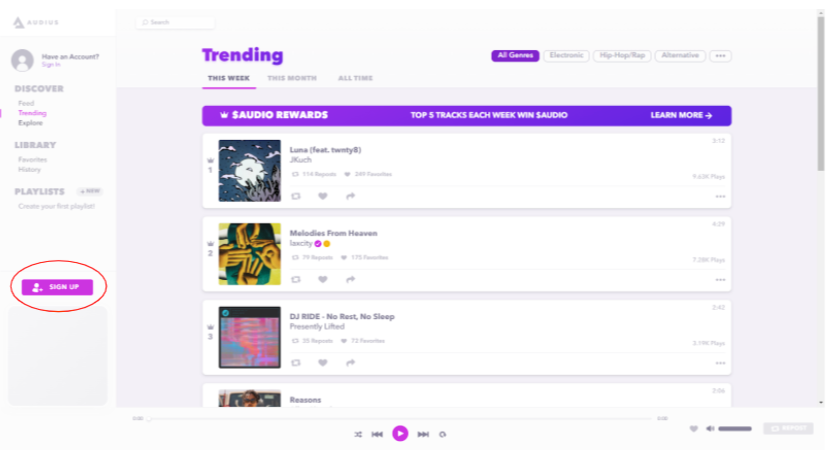

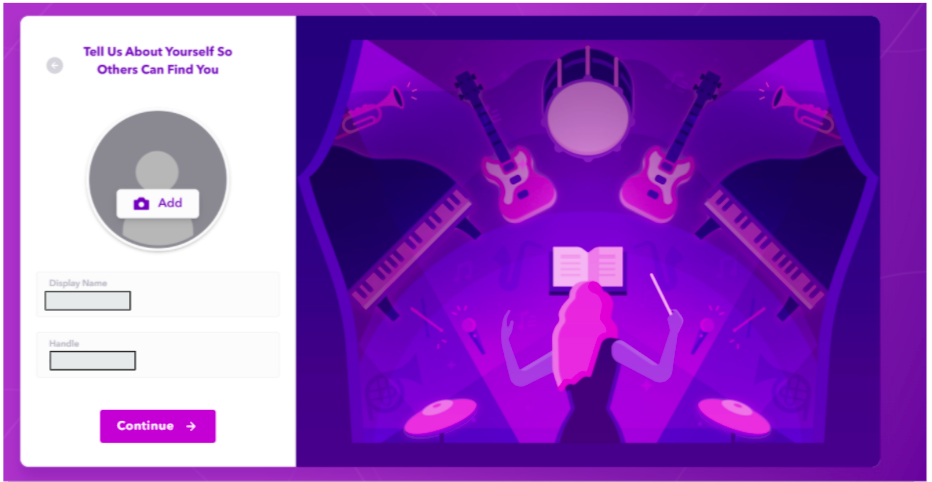

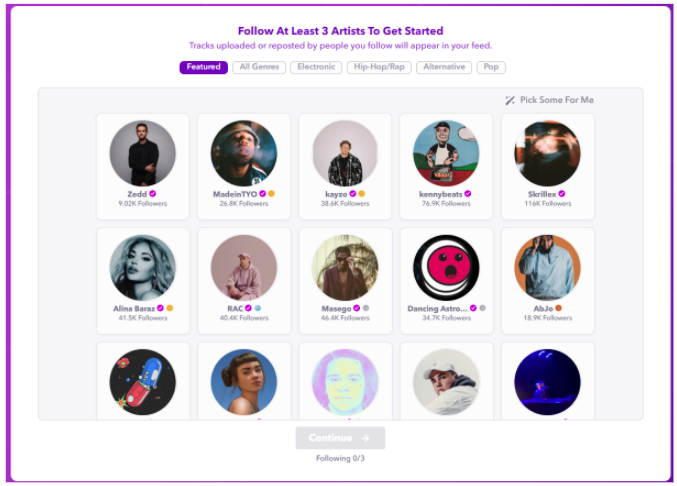

Audius, a web3 music streaming platform, is one of the largest decentralized applications in web3 with 6 million monthly active users as of September 2021. To stream music, users take the following steps:

Signing up for Audius is just as easy as signing up for SoundCloud. However, on the backend, Audius created a wallet, associated that wallet with your user ID, began signing transactions on your behalf. Every time you listen to a track, the backend wallet commits this information to the blockchain as a signed transaction.

In 2017, the music industry generated $43 billion in revenue but only 12% of that made its way to artists. In contrast, artists on Audius receive 90% of the sales revenue, with the other 10% going to node operators that secure the network.

While the full royalty formula can be found here, it’s estimated that artists receive around $0.35 per stream. Spotify, on the other hand, pays artists around $0.00437 per stream.

1,000,000 stream on Spotify = ~$4,370

As Audius demonstrates, it is possible to create web3 applications which have a consumer friendly frontend with an expert friendly backend.

For more information on Audius, I highly recommend the following podcast:

Abstraction:

Moving away from Tokens

Web3 tokens are for producers, not consumers. Therefore, to ensure commerce moves in a decentralized direction, web3 should hide tokens as much as possible. In the same way that few mainstream users know how to self-host a website from scratch, very few users need to know the tokenomics of web3 services they use.

Instead of a decentralized revolution, web3 must be a decentralized evolution - radically different under the hood with little change in user experience. One potential solution would be the widespread adoption of stablecoins like USDC or UST. Another would be for vendors to internalize the cost of transacting in tokens, allowing users to transact in whatever currency they choose - even dollars - similar to businesses like VISA.

Web3 must move forward in a way which continues to provide the utility to the average consumer while increasing value capture for producers. Instead of expecting 65 year old electricians to navigate complex financial ecosystems, swapping and staking tokens like a NASDAQ floor trader, web3 should move towards the “one-click purchase” option they have come to expect.

-Michael

If you made it this far, you'll probably like some of my other articles. Click below to make sure you don't miss one: